UPSC PRELIMS+MAINS

A) Economy

-

Lithium Batteries, Solar Photovoltaics (PV) and Champion Sectors in India (IE)

- Context: The government has imposed a safeguard duty on solar cells for one more year till July 2021 to protect domestic manufacturers and discourage cheap imports from countries like China.

Analysis

- The move followed a recommendation by the Commerce Ministry’s investigation arm Directorate General of Trade Remedies (DGTR) for the continued imposition of the duty for one more year.

- After considering the findings of the DGTR, the Department of Revenue, Ministry of Finance, imposed “a safeguard duty” on the product.

Directorate General of Trade Remedies

- The Directorate General of Trade Remedies (DGTR) functions as an attached office of Department of Commerce, Ministry of Commerce and Industry.

- DGTR deals with Anti-dumping, Countervailing Duty (CVD) and Safeguard measures.

- It also provides trade defense support to our domestic industry and exporters in dealing with increasing instances of trade remedy investigations instituted against them by other countries.

- Safeguard levies seek to protect local industry against sudden import surges. Anti-dumping duties are imposed when overseas exporters are seen to be selling products below fair market value. Countervailing Duty (CVD) is an additional import duty imposed on imported products (by the importing country) when such products enjoy benefits like export subsidies and tax concessions in the country of their origin.

Nature of Solar Photovoltaics (PV) manufacturing in India

- The supply chain of solar photovoltaic panel manufacturing is as follows:

- silicon production from silicates (sand);

- production of solar grade silicon ingots;

- solar wafer manufacturing; and

- PV module assembly.

- The capital expenditure and technical know-how needed for these processes decrease from the first item to the last, i.e. silicon production is more capital-intensive than module assembly.

- Most Indian companies are engaged in only module assembly or wafer manufacturing and module assembly.

- Almost no Indian company is involved in silicon production, although a few are making strides towards it.

- According to the Ministry of New and Renewable Energy (2018), India has an annual solar cell manufacturing capacity of about 3 GW while the average annual demand is 20 GW.

- The shortfall is met by imports of solar panels mainly from China.

- In the solar panel manufacturing sector, the Indian government allows 100% foreign investment as equity and it qualifies for automatic approval.

- The government is also encouraging foreign investors to set up renewable energy-based power generation projects on a build-own-operate basis.

- India now has the third-largest solar installed capacity in the world (source: PIB).

- It is one of the few countries on track to meet its three key NDC (Nationally Determined Contributions under the 2015 Paris Agreement) targets –

- achieve 40% non-fossil-fuel-based installed power capacity,

- reduce 33%–35% emissions, and

- create a carbon sink of 2.5 to 3 billion tons of carbon dioxide – by 2030.

- Solar PV manufacturing is one of the strategic champion sectors announced by the government as part of Aatmanirbhar

- India’s energy consumption is just one-third of the world’s average, which has enormous scope for expansion.

- Even at such low levels, 73% of the country’s greenhouse gas emissions result from energy production, calling for aggressive electrification from cleaner fuels and greening of our economy.

Why does India lags in Solar Photovoltaics (PV) manufacturing? – Lessons from China

- China’s cost advantage derives from capabilities on three fronts.

- The first is core competence. The six largest Chinese manufacturers had core technical competence in semiconductors before they turned to manufacturing solar cells at the turn of the century.

- Indian companies had no learning background in semiconductors when the solar industry in India began to grow from 2011.

- The second source of cost advantage for China comes from government policy. The Chinese government has subsidized land acquisition, raw material, labour and export, among others.

- None of this is matched by the Indian government.

- The third is the cost of capital. The cost of debt in India (11%) is highest in the Asia-Pacific region, while in China it is about 5%.

Lithium Batteries

- Besides solar, even the lithium batteries for Electric Vehicles (EVs) are sourced from China due to the non-availability of Lithium in India.

- India currently imports all its lithium needs.

- As India has no lithium reserves of its own, the government has started to reach out to other countries.

- The so-called lithium-triangle of Chile, Argentina and Bolivia is particularly interesting for India.

- This triangle is not only believed to hold 50 per cent of the world’s lithium reserves, but it is also offering the cheapest extracting process of lithium from brines (a high concentration salt solution)

- Reserves of lithium, a rare metal (but not a Rare Earth Element (REE)) critical to build batteries for electric vehicles, have recently been discovered in Mandya, 100 km from Bengaluru – a find that should boost local manufacturing of EV batteries.

Champion Sectors

- These sectors have been identified in both manufacturing and services sectors (total 27), for promoting their development and achieving their potential.

- Department of Industrial Policy and Promotion (DIPP), the nodal department for ‘Make in India’, would spearhead the initiative for the Champion Sectors in manufacturing and Department of Commerce would coordinate the proposed initiative for the Champion Sectors in Services.

Champion Sectors in Services

- The Department of Commerce will give focused attention to 12 identified Champion Services Sectors for promoting their competitiveness and realizing their potential.

- These include:

- Information Technology & Information Technology enabled Services (IT & ITeS),

- Tourism and Hospitality Services,

- Medical Value Travel,

- Transport and Logistics Services,

- Accounting and Finance Services,

- Audio Visual Services,

- Legal Services,

- Communication Services,

- Construction and Related Engineering Services,

- Environmental Services,

- Financial Services and

- Education Services.

- A dedicated fund of Rs. 5000 crores has been proposed to be established to support initiatives for sectoral Action Plans of the Champion Sectors.

- Also, these services are substantial part of ‘Goods’ as well.

- Thus, the competitive services sector will add to the competitiveness of the manufacturing sector as well.

- This initiative aims to raise the share of India’s services sector in global services exports from 3.3% in 2015 to 4.2% in 2022.

- The share of services in Gross Value Added (GVA) was about 5 3% for India in 2015-16 (61 % including construction services).

- A goal of achieving a share of services in GVA of 60 % (67% including construction services) has also been envisaged by the year 2022.

Champion Sectors in Manufacturing

- The government has identified these sectors which have the potential to become global champions and drive double- digit growth in manufacturing.

- These include:

- Aerospace and Defence

- Automotive & Auto Components

- Pharmaceuticals and Medical Devices

- Bio-Technology

- Capital Goods

- Textiles and Apparels

- Chemicals and Petro-Chemicals

- Electronics System Design and Manufacturing (ESDM)

- Leather & Footwear

- Food Processing

- Gems and Jewellery

- Shipping

- Railways

- Construction

- New and Renewable Energy

- The sectors have been identified for renewed focus under the Make in India version 2.0.

-

Antitrust Cases and the Competition Commission of India (TH)

- Context: Google is facing a new antitrust case in India in which the U.S. tech giant is alleged to have abused its Android operating system’s position in the smart television market.

Analysis

- The competition watchdog (Competition Commission of India) is investigating Google in two other cases—one involving dominance in smartphones, while the other is for using its market position to promote Google Pay over other apps.

- The case also comes in the backdrop of many Indian startups opposing Google’s Play Store policies and building their own mini-app stores.

- It also comes as Google faces new antitrust challenges in the U.S., and a potential antitrust probe in China that is set to look into how it allegedly uses the dominance of its Android mobile operating system to stifle competition.

- The antitrust laws proscribe unlawful mergers and business practices in general terms, leaving courts to decide which ones are illegal based on the facts of each case.

- Anti-competitive practices represent a range of business practices that lead to the emergence of one or a few dominant firms, which are then able to restrict competition in the industry in a bid to preserve their dominant status.

Competition Commission of India

- The Competition Act, 2002, as amended by the Competition (Amendment) Act, 2007:

- prohibits anti-competitive agreements;

- abuse of dominant position by enterprises and;

- regulates combinations (acquisition, acquiring of control and M&A),

- which causes or likely to cause an appreciable adverse effect on competition within India.

- The objectives of the Act are sought to be achieved through the Competition Commission of India (CCI), a quasi-judicial body.

- CCI consists of a Chairperson and 6 Members appointed by the Central Government.

Objective of Competition Commission of India (CCI)

- Remove negative competitive practices

- Promote sustainable market competition

- Protect the rights of the consumer

- Protect the freedom of trade in Indian markets

- Protect the rights of small traders from the large traders to ensure their survival

- Advice and give suggestions to Competition Appellate Tribunal

- Run informative campaigns and create public awareness about fair competitive practices.

- The Commission is also required to give opinion on competition issues on a reference received from a statutory authority established under any law.

- It also undertakes competition advocacy, create public awareness and impart training on competition issues.

- Right to appeal under the Competition Act has been restricted to only certain orders of the Commission.

- In 2017, the Competition Appellate Tribunal (COMPAT) was replaced by the National Company Law Appellate Tribunal (NCLAT) which will now function as the appellate body under the Competition Act, 2002 (Competition Act).

- In addition, like its predecessor, the NCLAT would also be relevant authority to seek a compensation under the Competition Act.

- The COMPAT was quick to understand and apply the nuances of competition law.

- On the contrary, the NCLAT, responsible for adjudicating matters under the Indian Companies Act, 2013 and the Insolvency and Bankruptcy Code, 2016 will now have appeals under the Competition Act to deal with.

Who can approach CCI?

- Recently the National Company Law Appellate Tribunal, in the appeal case Samir Agarwal v. Competition Commission, ruled that, a ‘person’ must necessarily be one “who has suffered an invasion of their legal rights as a consumer or as a beneficiary of healthy competitive practices”.

- Locus Standi can be simplified as the capacity to take action by himself or appear in court, only by an individual to seek justice for violation of his own rights.

Recent spree of mergers and acquisitions in India

- The Mergers, amalgamations and acquisitions in India are also regulated by the Competition Commission of India (CCI).

- CCI is the statutory authority responsible for reviewing combinations and assessing whether or not they cause or are likely to cause an appreciable adverse effect on competition within the relevant market(s) in India.

- CCI is a watchdog of market competition. Certain Checks are undertaken before any acquisition is approved by it.

- 1. if it limits the number of suppliers available to customer in this market in India;

- 2. if it reduces the intensity of innovation in the technology;

- 3. If the substantial market position of the Parties in the market will reduce or eliminate the competitive pressure that would prevail in the absence of Proposed Combination;

- 4. If it reduces the bargaining power that the customers enjoyed on account of fair competition in market.

- 5. if it increases the cost of the entrants and rivals to compete.

Green Channel of CCI

- In a bid to facilitate mergers and acquisitions (Combination) in the country, the Competition Commission of India (CCI) has taken inspiration from the Customs Department and established a ‘green channel’.

- The CCI characterizes the ‘green channel’ as an automatic system of approval for Combinations wherein the Combination is deemed to be approved upon filing the notice in the format prescribed.

- The criteria for ‘eligibility’ for such combinations is that “…the parties to the combination, their respective group entities and/or any entity in which they, directly or indirectly, hold shares and/or control:

- do not produce/provide similar or identical or substitutable product(s) or service(s);

- are not engaged in any activity relating to production, supply, distribution, storage, sale and service or trade in product(s) or provision of service(s):

- which are at different stage or level of production chain; and

- which are complementary to each other.”

- In a boost to the green channel route, the CCI in October 2019 approved its first Combination under the green channel to acquisition by Sachin Bansal owned BAC Acquisitions Private Limited (BACQ) of Essel Mutual Fund.

Herfindahl– Hirschman Index (HHI)

- It can be used for measuring the level of competition or market concentration in a relevant market.

Toothless regulator

- The Competition Commission of India (CCI) is the statutory body mandated to regulate anti-competitive activity in the country based on the Competition Act 2002.

- The CCI started full-fledged operations in 2010, following the repealing of the Monopoly and Restrictive Trade Practices Act, which was in force from 1969 to 2009.

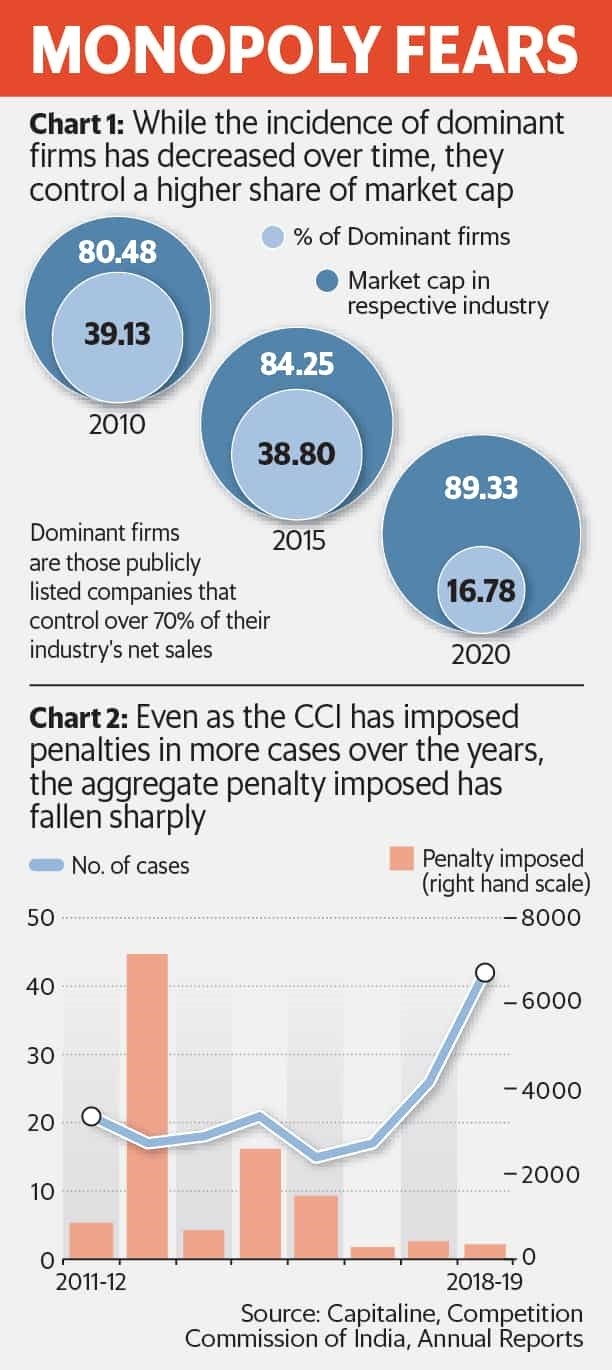

- Over the past 10 years, the CCI has imposed penalties amounting to ₹13,381 crore, but less than 1% of that amount (about ₹127 crore) has been actually realized (See chart 2).

- Most of the orders of the CCI are under appeal before the National Company Law Appellate Tribunal (NCLAT) or under challenge in the high courts or the Supreme Court.

The many loopholes

- The inability of CCI to consistently adjudicate and enforce punitive measures points to certain lacunae in the provisions of the Competition Act, 2002 from which the CCI derives its authority.

- Even though the 2002 Act represents an improvement from its extremely restrictive predecessor —the MRTP ACT—it remains riddled with loopholes and ambiguities.

- For instance, the law allows the CCI to leave some leeway for “relative advantage, by way of contribution to the economic development.” This may allow large firms to justify their anti-competitive practices in the name of development.

- The most significant challenges that the CCI will encounter in the future, however, are in new emerging spheres such as telecom, internet and big-technology.

- In these spheres, the CCI’s functions also overlap with those of regulatory bodies such as the Telecom Regulatory Authority of India (TRAI).

- To assess and ensure competition in these spheres, CCI will require staff with specialized knowledge in technology as well as an understanding of modern industrial economics.

Concentration risks in India’s internet economy

- Concentration risks (consolidation of market power in these dominant firms) abound India’s newly emerging internet economy too.

- And these risks are a lot harder to quantify since many of the firms are either unlisted private entities or listed in stock markets outside the country.

- The distinguishing feature of internet and telecom markets is the accruing of ‘network effects’, a phenomenon whereby a product or service gains additional value as more people use it.

- There can be situations where large internet firms and technology companies can pose anti-competitive challenges due to their dominance arising from network effects.

B) Geography, Environment and Biodiversity

-

3.Precision Farming (PIB)

- Precision farming is an approach where inputs are utilised in precise amounts to get increased average yields, compared to traditional cultivation techniques.

- In India, one major problem is the small field size. More than 58 per cent of operational holdings in the country have size less than one hectare (ha).

- Only in the states of Punjab, Rajasthan, Haryana and Gujarat do more than 20 per cent of agricultural lands have an operational holding size of more than four ha.

Why precision farming

- To increase agriculture productivity

- Prevents soil degradation

- Reduction of chemical application in crop production

- Efficient use of water resources

- Dissemination of modern farm practices to improve quality, quantity and reduced cost of production

- Developing favourable attitudes

- Precision farming changing the socio-economic status of farmers

Drawbacks of precision farming

- High cost

- Lack of technical expertise knowledge and technology

- Not applicable or difficult/costly for small land holdings

- Heterogeneity of cropping systems and market imperfections

Some of the objectives of ‘Precision Agriculture’ are:

- A) Maximize crop production

- B) Minimize environmental damage

- C) Consider spatial variability of land

Drip irrigation

- Drip irrigation is the best delivery system for soluble fertilisers.

- It also drastically reduces the propagation of weeds and the need for herbicides.

-

National Cyclone Risk Mitigation Project (NCRMP) (PIB)

- The overall objective of the Project is to undertake suitable structural and non-structural measures to mitigate the effects of cyclones in the coastal states and UTs of India.

- National Disaster Management Authority (NDMA) under the aegis of Ministry of Home Affairs (MHA) will implement the Project.

- The Project has identified 13 cyclone prone States and Union Territories (UTs), with varying levels of vulnerability.

- Category I: Higher vulnerability States i.e. Andhra Pradesh, Gujarat, Odisha, Tamil Nadu and West Bengal.

- Category II: Lower vulnerability States i.e. Maharashtra, Karnataka, Kerala, Goa, Pondicherry, Lakshadweep, Daman and Diu, Andaman and Nicobar Islands.

- The Project is being implemented with the financial help from the World Bank.

- Under NCRMP, NDMA is also developing a Web-based Dynamic Composite Risk Atlas (Web-DCRA) in collaboration with IMD and state Governments of coastal states.

- The post-monsoon months of October and November offer the favourable atmosphere and sea conditions for the occurrence of cyclonic storms, which mainly affect coastal Andhra Pradesh, Odisha and West Bengal in east coast and Gujarat in west coast.

- Various mobile apps launched by IMD includes: Damini for lightning forecast, Mausam & Umang for weather forecast including cyclone warning and Meghdoot for agrometeorological advisories.

- The cyclone forecast accuracy has significantly improved in recent years as has been demonstrated during cyclones Phailin (2013), Hudhud (2014), Vardah (2016), Titli (2018), Fani & Bulbul (2019) and Amphan & Nisarga (2020).

Benefits of Tropical Cyclones

- Relieve drought conditions.

- Carry heat and energy away from the tropics and transport it towards temperate latitudes, thus helps to maintain equilibrium in the Earth’s troposphere and

- Maintain a relatively stable and warm temperature worldwide.

C) Schemes/Policies/Initiatives/Social Issues

-

5.Technology Incubation and Development of Entrepreneurs (TIDE) 2.0 (PIB)

- Context: Union Minister for Education virtually inaugurated the Gyan Circle Ventures (to function as a Technology Incubation and Development of Entrepreneurs(TIDE 2.0) incubation center as approved by the Ministry of Information Technology (MeitY)), a MeitY funded Technology Business Incubator (TBI) of Indian Institute of Information Technology, Sri City (Chittoor), Andhra Pradesh through Video Conference.

Analysis

- Technology Incubation and Development of Entrepreneurs (TIDE 2.0) Scheme of Ministry of Electronics and Information Technology (MeitY) has been envisaged to promote tech entrepreneurship through financial and technical support to incubators engaged in supporting Information and Communication Technology (ICT) startups primarily engaged in using emerging technologies such as Artificial Intelligence (AI), Block-chain, Cyber Physical Systems (CPS), Cyber Security, Internet of Things (IoT), Robotics, etc. in seven pre-identified areas of societal relevance.

- The Scheme will be implemented through 51 incubators and handholding of approximately 2000 tech start-ups over a period of five years.

- It will support tech startups addressing societal challenges in seven selected thematic areas identified based on national priorities in the realms of:

- (i) Healthcare

- (ii) Education

- (iii) Agriculture

- (iv) Financial inclusion including digital payments

- (v) Infrastructure and transportation

- (vi) Environment and clean tech

- (vii) Clean Energy Solutions

- MeitY Startup Hub (MSH) would be setup under TIDE 2.0 to ensure synergistic linkages among the TIDE centres, theme-based incubation centres, Centre of Excellences on emerging technologies and other collaborative platforms.

-

Measures for Aviation Sector (PIB)

- Lifeline Udan was launched to transport experts and equipment to every corner of the country (NER, hilly and island states) during Covid-19 lockdown.

- The government has discontinued levying of ‘airport operator charge’ or ‘fuel throughput charge’ at airports, heliports and airstrips across the country, according to a Ministry of Civil aviation circular.

- Fuel throughput fee is the payment made by fuel suppliers to the airport developer.

- The proposal to bring Aviation Turbine Fuel (ATF) under the ambit of GST is before the GST Council which has representation from the States as well.

Ude Desh Ka Aam Nagrik 4.0 (UDAN 4.0)

- Context: 78 new routes under the 4thround of Regional Connectivity Scheme (RCS)- Ude Desh Ka Aam Nagrik (UDAN) have been approved following the three successful rounds of bidding by the Ministry of Civil Aviation.

Analysis

- So far, 766 routes have been sanctioned under the UDAN scheme. 29 served, 08 unserved (including 02 heliports and 01 water aerodrome), and 02 underserved airports have been included in the list for approved routes.

- The 4th round of UDAN was launched in December 2019 with a special focus on North-Eastern Regions, Hilly States, and Islands.

- The airports that had already been developed by AAI are given higher priority for the award of VGF (Viability Gap Funding) under the Scheme.

- Under UDAN 4, the operation of helicopter and seaplanes is also been incorporated.

Ude Desh Ka Aam Nagrik

- Launched by the Civil Aviation Ministry.

- Airports Authority of India (AAI) is the implementing agency of UDAN.

- The scheme UDAN envisages providing connectivity to un-served and under-served airports of the country through revival of existing air-strips and airports.

- The scheme aims to stimulate regional connectivity with flights covering distances between 200 to 800 km, with no lower limit set for hilly, remote, island and security sensitive regions, through a market-based mechanism.

How it works:

- Interested airline and helicopter operators can start operations on hitherto un-connected routes by submitting proposals to the Implementing Agency.

- The operators could seek a Viability Gap Funding (VGF) apart from getting various concessions.

- Viability Gap Finance means a grant to support projects that are economically justified but not financially viable.

- The States will have to bear 20% towards VGF. The share will be 10% for North Eastern States and Union Territories.

- All such route proposals would then be offered for competitive bidding through a reverse bidding mechanism (bidders who offer the least bid wins) and the route would be awarded to the participant quoting the lowest VGF per Seat.

- The operator submitting the original proposal would have the Right of First Refusal on matching the lowest bid in case his original bid is within 10% of the lowest bid.

- The successful bidder would then have exclusive rights to operate the route for a period of three years.

- Such support would be withdrawn after a three-year period, as by that time, the route is expected to become self-sustainable.

- The selected airline operator would have to provide a certain minimum/maximum UDAN Seats (subsidized rates) on the UDAN Flights for operations through fixed wing aircraft/helicopters.

- The fare for a one hour journey of appx. 500 km on a fixed wing aircraft or for a 30 minute journey on a helicopter would now be capped at Rs. 2,500.

- The passenger fares are kept affordable through:

- Central Government would provide concessions in the form of reduced excise duty, service tax etc. and freedom to enter into code sharing arrangements with domestic as well as international airlines

- State governments will have to lower the VAT on Aviation Turbine Fuel to 1% or less, besides providing security and fire services free of cost and electricity, water and other utilities at substantially concessional rates.

- Airport operators shall not impose Landing and Parking charge and Terminal Navigation Landing Charges in addition to discounts on Route Navigation Facility Charges.

- A Regional Connectivity Fund (RCF) would be created to meet the viability gap funding requirements under the scheme.

- The RCF levy per departure will be applied to certain domestic flights.

- The partner State Governments (other than North Eastern States and Union Territories where contribution will be 10 %) would contribute a 20% share to this fund.

- Priority areas for improving connectivity are the North East, Jammu & Kashmir, Uttarakhand, Himachal Pradesh, Andaman & Nicobar Islands and Lakshdweep.

- Helicopter operations under the Scheme are limited to Priority Areas only.

- Air India’s subsidiary Alliance Air was the first airline to start operating flights between Delhi and Shimla under the Regional Connectivity Scheme (RCS).

- Exemption from payment of landing and parking charges for civil aircraft operating from IAF airfields under Regional Connectivity Scheme has already been published in the Gazette of India for 32 airfields and 5 Advanced Landing Grounds.

UDAN Round 2

- It allowed the state governments to provide subsidy for international flights to be launched from their states.

UDAN Round 3

- Key Features of UDAN 3 included:

- Inclusion of Tourism Routes in coordination with the Ministry of Tourism

- Inclusion of Seaplanes for connecting Water Aerodromes, and

- Bringing in a number of routes in the North-East Region under the ambit of UDAN.

-

Special Accelerated Road Development Programme in North Eastern Areas (SARDP-NE) (PIB)

- Context: The Ministry of Road Transport and Highways has enhanced the allocation of funds for expenditure under Special Accelerated Road Development Programme in North Eastern Areas (SARDP-NE) related works during the current financial year.

- Expenditure envisaged is to be incurred from National Investment Fund.

Analysis

- The scope of “Special Accelerated Road Development Programme in North East (SARDP-NE)” programme has been enlarged from time to time, since 2005.

Objectives of SARDP-NE:

- Up-gradation of National Highways connecting State Capitals to 2/ 4 lane;

- Providing connectivity to 88 District Headquarter towns of NER by at least 2-lane road;

- Providing road connectivity to backward and remote areas of NE region to boost socio – economic development;

- Improving roads of strategic importance in border areas;

- Improving connectivity to neighbouring countries.

SARDP-NE programme has been divided into 3 parts:

- Part 1 Phase ‘A’ for all NE states except Arunachal Pradesh (includes widening 2/4 laning of existing National and State Highways)

- Part 2 Arunachal Pradesh Package of Roads and Highways also known as (Arunachal Package)

- Part 3: Phase ‘B’ (Building strategic roads in the border areas and connecting roads to neighboring countries) These programmes once implemented fully will change the face of the North Eastern States.

- In order to expedite road construction, Ministry of Road Transport and Highways has set up a company named ‘National Highways and Infrastructure Development Corporation Ltd’ (NHIDCL) for construction/upgradation/widening of National Highways in the Region.

National Investment Fund

- The cabinet Committee on Economic Affairs (CCEA) in January, 2005 had approved the constitution of a National Investment Fund (NIF).

- The purpose of the fund was to receive disinvestment proceeds of central public sector enterprises and to invest the same to generate earnings without depleting the corpus.

- The Fund will be professionally managed to provide sustainable returns to the Govt., without depleting the corpus. Selected Public Sector Mutual Funds will be entrusted with the management of the corpus of the Fund

- The earnings of the Fund were to be used for selected Central social welfare Schemes.

- This fund was kept outside the consolidated fund of India.

Restructuring of NIF

- In 2013, CCEA restructured the NIF and decided to do away with the management of the disinvestment proceeds by the Fund Managers of NIF.

- It was decided by CCEA that the entire disinvestment proceeds from 01.04.2013 will be credited to the existing ‘Public Account’ under the head NIF and they would remain there until withdrawn/invested for the approved purpose.

- The allocations out of the NIF will be decided in the annual Government Budget.

Use of the NIF proceeds

- The money procured through disinvestment has been entered as ‘Other Receipts’ in the budget. Such proceeds and transferred to the NIF.

- In the past, especially from the difficult times of 2008 onwards around 75 per cent of the NIF money was used to finance social sector schemes and the remaining for capitalization of PSUs. But from 2013-14 onwards, the use of NIF proceeds were changed.

- In this context, the NIF corpus would be utilized for the following purposes:

- Subscribing to the shares issued by the CPSEs including PSBs and Public Sector Insurance Companies, to ensure that 51% ownership of the Government in those CPSEs/PSBs/ Insurance Companies, is kept.

- Preferential allotment of shares of the CPSE so that Government shareholding does not go down below 51% in all cases where the CPSE is going to raise fresh equity.

- Recapitalization of public sector banks and public sector insurance companies.

- Investment by Government in RRBs/IIFCL/ NABARD/Exim Bank;

- Equity infusion in various Metro projects;

- Investment in Bhartiya Nabhikiya Vidyut Nigam Limited and Uranium Corporation of India Ltd.

- Investment in Indian Railways towards capital expenditure.

National Investment Fund is different from National Investment and Infrastructure Fund

National Investment and Infrastructure Fund (NIIF)

- NIIF has been set up as a Trust, to raise debt to invest in the equity of infrastructure finance companies such as Indian Rail Finance Corporation (IRFC) and National Housing Bank (NHB).

- “Debt” involves borrowing money to be repaid, plus interest, while “equity” involves raising money by selling interests in the company.

- Its creation was announced in the Union Budget 2015-16.

- Initial authorized capital of the Fund is set at Rs 20000 crore, which will be revised from time to time in accordance with the Ministry of Finance’s decision.

- It has been established as a quasi-sovereign wealth fund.

- A typical sovereign wealth fund (SWF) will be a state-owned investment company like the China Investment Corporation which are owned by governments and invests their own money (foreign exchange reserves) in foreign countries.

- These funds are known as SWFs and invests in assets such as stocks, bonds, real estate, commodities etc.

- The NIIF is not such an entity and hence can’t be called as an SWF in the pure sense.

- The idea is that these infrastructure finance companies can then leverage this extra equity, manifold. In that sense, NIIF is a banker of the banker of the banker.

- NIIF is envisaged as a fund of funds with the ability to make direct investments as required.

- As a fund of fund it may invest in other SEBI registered funds.

- The objective of NIIF is to maximize economic impact mainly through infrastructure development in commercially viable projects, both greenfield and brownfield, including stalled projects.

- It could also consider other nationally important projects, for example, in manufacturing, if commercially viable.

- It can also raise funds through suitable instruments including off-shore credit enhanced bonds.

- It can also provide equity/quasi-equity support to those Non Banking Financial Companies (NBFCs)/Asset Management Companies (AMCs)/Financial Institutions (FIs) that are engaged mainly in infrastructure financing.

- As per the operational framework, NIIF is not a single entity. There can be more than one fund.

- The NIIF has been established as one or more Alternate Investment Funds (AIF) under the SEBI Regulations.

- Alternate investment funds (AIFs) are regulated by the Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012, and classified under three categories – Categories I, II and III, from the angle of tax treatment under provisions of Income Tax Act.

- Since it was set up as Category II AIFs, the NIIF is eligible for a pass through status under the Income Tax Act.

- A ‘pass-through’ status means that the income generated by the fund would be taxed in the hands of the ultimate investor, and the fund itself would not have to pay tax on the same.

Nature of Government ownership

- The NIIF Funds work on a model whereby equity participation from strategic partners (including overseas sovereign / quasi-sovereign / multilateral / bilateral investors) is invited, alongside Government’s contribution.

- Government’s contribution/share in the corpus will be 49% in each entity set up as an alternate Investment Fund (AIF) and will neither be increased beyond, nor allowed to fall below, 49%. The whole of 49% would be contributed by the Government of India directly.

- As on date, three funds have been established by the Government under the NIIF platform and registered with SEBI as Category II Alternative Investment Funds.

- National Investment and Infrastructure Fund II (“Strategic Fund”) is one of those three funds. The other two funds are:

- National Investment and Infrastructure Fund (or Master Fund) and

- NIIF Fund of Funds – I.

- The objective of National Investment and Infrastructure Fund II (“Strategic Fund”) is to invest largely in equity and equity-linked instruments.

- The Strategic Fund will focus on green field and brown field investments in the core infrastructure sectors.

- The functions of NIIF are as follows:

- Fund raising through suitable instruments including off-shore credit enhanced bonds, and attracting anchor investors to participate as partners in NIIF;

- Servicing of the investors of NIIF.

- Considering and approving candidate companies/institutions/ projects (including state entities) for investments and periodic monitoring of investments.

- Investing in the corpus created by Asset Management Companies (AMCs) for investing in private equity.

- Preparing a shelf of infrastructure projects and providing advisory services.

-

Jan Andolan for COVID-19 Appropriate Behaviour (PIB)

- Context: Prime Minister launched a public movement today and appealed everyone to unite in the fight against corona.

Analysis

Jan Andolan for COVID-19 Appropriate Behaviour

- This campaign is launched in view of the upcoming festivals and winter season as well as the opening up of the economy with the aim to encourage People’s Participation (Jan Andolan).

- It endeavours to be a Low Cost High Intensity Campaign with the Key Messages of ‘Wear Mask, Follow Physical Distancing, Maintain Hand Hygiene’

- It’s a perfect example of information, education and communication (IEC) Strategy for influencing Attitude of Public.

- A Concerted Action Plan will be implemented by Central Government Ministries/ Departments and State Governments/ Union Territories

- It includes

- Region- specific targeted communication in high case-load districts.

- Simple and easily understandable messages to reach every citizen

- Dissemination throughout the country using all media platforms

- Banners and Posters at public places; involving Frontline workers and Targeting Beneficiaries of Government Schemes

- Hoardings/ wall paintings/ electronic display boards in government premises

- Involvement of Local and National influencers to drive home the message

- Running mobile vans for regular awareness generation

- Audio messages; pamphlets/ brochures on awareness

- Seeking support of Local Cable Operators for running COVID messages

- Coordinated media campaign across platforms for effective outreach and impact

Similar approach in the past

- CSwachh Bharat Mission (Gramin) was not about constructing toilets but aims at behavior change of the masses to adopt better sanitation practices.

- Therefore, information, education and communication (IEC) strategies, planning and their effective implementation is the key to the success of Swachh Bharat.

D) Science and Technology/Defence/Space

-

9.Television Rating Points (TRPs) (TH)

- ontext: Manipulation of Television Rating Points (TRPs) had been busted by Mumbai Police.

- It was done by rigging the devices used by the Broadcast Audience Research Council (BARC) India, which has the mandate to measure television audience in India.

Analysis

What is TRP?

- In simple terms, TRPs represent how many people, from which socio-economic categories, watched which channels for how much time during a particular period.

- This could be for an hour, a day, or even a week.

- The data is usually made public every week.

- Telecom Regulatory Authority of India (TRAI) in 2018 defined its importance as: “On the basis of audience measurement data, ratings are assigned to various programmes on television.

- Television ratings in turn influence programmes produced for the viewers.

- Better ratings would promote a programme while poor ratings will discourage a programme. Higher the ratings higher the advertisement prices for that particular programme

- TRPs are the main currency for advertisers to decide which channel to advertise on by calculating the cost-per-rating-point (CPRP).

How is TRP calculated?

- Broadcast Audience Research Council (BARC) has installed “BAR-O-meters” in over 45,000 empanelled households.

- These households are classified into 12 categories under the New Consumer Classification System (NCCS), the so-called “new SEC” adopted by BARC in 2015

- Classification is based on the education level of the main wage earner and the ownership of consumer durables from a list of 11 items ranging from an electricity connection to a car.

- While watching a show, members of the household register their presence by pressing their viewer ID button — every person in household has a separate ID — thus capturing the duration for which the channel was watched and by whom, and providing data on viewership habits across age and socio-economic groups.

How can TRP data be rigged?

- If broadcasters can find the households where devices are installed, they can either bribe them to watch their channels, or ask cable operators or multi-system operators to ensure their channel is available as the “landing page” when the TV is switched on.

- For TRPs, it does not matter what the entire country is watching, but essentially what the 45,000-odd households supposed to represent TV viewership of the country have watched.

Flaws in present system

- TRAI said: “One of the biggest challenges has been the absence of any specific law through which the agents/ suspects involved in panel tampering/infiltration could be penalised”.

Broadcast Audience Research Council (BARC)

- It is an industry body jointly owned by advertisers, ad agencies, and broadcasting companies, represented by The Indian Society of Advertisers, the Indian Broadcasting Foundation and the Advertising Agencies Association of India.

- Though it was created in 2010, the I&B Ministry notified the Policy Guidelines for Television Rating Agencies in India on January 10, 2014 and registered BARC in July 2015 under these guidelines, to carry out television ratings in India.

- This means BARC is not a statutory body.

Source-The Hindu, PIB, IE and Others

Click here to get our all Courses

Click here to follow our latest updates

If you find this post helpful, then do share your thoughts with us by commenting.