Context: The Reserve Bank of India (RBI) constituted a six-member committee headed by Sudarshan Sen, former executive director, Reserve Bank of India (RBI).The committee will: Review the existing legal and regulatory framework and recommend measures to improve the efficacy of asset reconstruction companies (ARCs); Review their role in stressed asset resolution under the Insolvency and Bankruptcy Code (IBC), and Suggest means to improve liquidity and trading of security receipts.

Analysis

- Asset reconstruction companies are a special type of financial institutions that buys the debts of banks at a mutually agreed value and attempts to recover the debts or associated securities by itself.

- ARC is a company incorporated under the Companies Act.

- It is registered with the Reserve Bank of India under The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act).

- The SARFAESI Act helps reconstruction of bad assets without the intervention of courts.

- SARFAESI Act stipulates various measures that can be undertaken by ARCs for asset reconstruction. These include: taking over or changing the management of the business of the borrower,the sale or lease of the business of the borrower entering into settlements restructuring or rescheduling of debt enforcement of security interest (means ARCs can take possession/sell/lease the supported asset like land, building etc.)

- In India, ARCs function under the supervision and control of Reserve Bank of India.

- They operate strictly as per SARFAESI Act and guidelines issued by Reserve Bank of India.

Need for ARC

- Rapid growth of bad debts/ non-performing assets was the chronic hurdle for healthy growth of Indian economy.

- Asset Reconstruction Companies were established as specialised entities to facilitate securitisation and asset reconstruction of non-performing asset thereby earliest resolution and bringing the liquidity in the system.

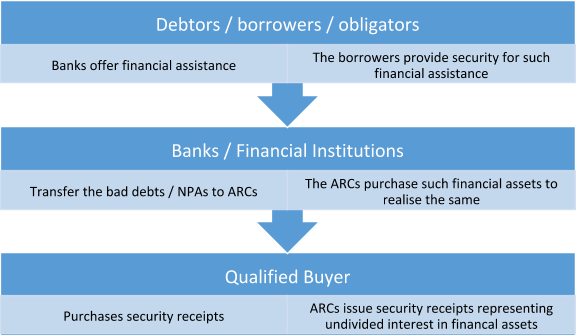

- Securitisation means acquisition of financial assets by an ARC from Banks/ FIs by raising of funds from Qualified Buyers (QBs) by issue of security receipts (SRs) representing undivided interest in such financial assets or otherwise.

- The ARCs take over a portion of the debts of the bank that qualify to be recognised as Non-Performing Assets. Thus, ARCs are engaged in the business of asset reconstruction or securitisation or both.

- All the rights that were held by the lender (the bank) in respect of the debt would be transferred to the ARC.

- The required funds to purchase such debts can be raised from Qualified Buyers.

- A Qualified Buyer (QB) means Financial Institution, Insurance Company, Bank, State Financial Corporation, State Industrial Development Corporation, Trustee, Foreign Institutional Investor, any category of non-institutional investors as may be specified by Reserve Bank of India or any other body corporate as may be specified by the Securities and Exchange Board of India.

- The ARC can take over only secured debts which have been classified as a non-performing asset (NPA).

- A non-performing asset (NPA) is a loan or an advance for which the principal or interest payment remained overdue for a period of 90 days.

- In case of agricultural advance, the account is classified as NPA, if the instalment of principle or interest thereon remain overdue for two crop seasons for short duration crops.

- Regaining the value through restructuring should be done within five years from the date of acquisition of the assets.

- The Government raised FDI in the sector to 100%.

- An ARC may issue bonds and debentures for meeting its funding requirements.

- But the chief and perhaps the unique source of funds for the ARCs is the issue of Security Receipts.

- Security Receipts (SR) are issued by ARCs, when Non-Performing Assets (NPAs) of commercial banks (CB) or financial institutions (FI) are acquired by the ARCs for the purpose of recovery.

- Security Receipt means a receipt or other security, issued by an ARC to any Qualified Buyers (QBs) pursuant to a scheme, evidencing the purchase or acquisition by the holder thereof, of an undivided right, title or interest in the financial asset involved in securitisation.

Capital Requirements for ARCs

- As per amendment made in the SARFAESI Act in 2016, an ARC should have a minimum net owned fund of Rs. 2 crore.

- The RBI raised this amount to Rs. 100 crore in 2017. The ARCs also have to maintain a capital adequacy ratio of 15% of its risk weighted assets.

- Risk-weighted assets are used to determine the minimum amount of capital that must be held by banks and other financial institutions in order to reduce the risk of insolvency.