UPSC PRELIMS+MAINS

A) Defence

1. India, Thailand, Singapore naval exercise concludes (TH)

Context: Indian Navy ships participated in the India, Singapore and Thailand Trilateral Maritime Exercise, SITMEX-2020 in Andaman Sea.

- The 27th edition of India-Singapore bilateral maritime exercise, SIMBEX-20, is scheduled to be held in the same area from November 23 to 25.

Analysis

- This was second edition of the India, Thailand and Singapore trilateral naval exercise, SITMEX-20,.

- SITMEX was held for the first time in 2019.

- It is aimed at strengthening the maritime inter-relationship (in terms of interoperability) amongst Singapore, Thailand, and India, and significantly contributes to enhancing the overall maritime security in the region.

B) Schemes/ Initiatives/ Awards and Social Issues

2. Coalition for Disaster-Resilient Infrastructure (CDRI) (PIB)

Context: PM in its G20 address to other members talked about CDRI initiative.

Analysis

- India launched the Coalition for Disaster-Resilient Infrastructure (CDRI) at the UN Secretary-General’s Climate Action Summit in New York, US, in September 2019.

- It has a secretariat in Delhi, supported by the UN Office for Disaster Risk Reduction (UNDRR), to enable knowledge exchange, technical support and capacity building.

- This international partnership of national governments, UN agencies, multilateral development banks, private sector, and knowledge institutions will promote the resilience of new and existing infrastructure systems to climate and disaster risks, thereby ensuring sustainable development

- CDRI’s mission is to rapidly expand the development of resilient infrastructure and retrofit existing infrastructure for resilience, and to enable a measurable reduction in infrastructure losses.

- In its formative stage, CDRI will focus on developing resilience in ecological infrastructure, social infrastructure with a concerted emphasis on health and education, and economic infrastructure with special attention to transportation, telecommunications, energy, and water.

- CDRI is bringing together developed and developing countries to build synergies to reach the goal of disaster-resilient infrastructure.

- SDG target 9.1 commits to developing sustainable and resilient infrastructure, while target 9a. seeks to facilitate its development in developing States through enhanced financial, technological and technical support to African countries, least developed countries (LDCs), landlocked developing countries (LLDCs) and small island developing States (SIDS).

- There are 12 founding members of CDRI:

- Australia, Bhutan, Fiji, Indonesia, Italy, Japan, Maldives, Mexico, Mongolia, Rwanda, Sri Lanka and the UK.

- In March 2020, the U.K. was confirmed as the first co-chair of the Governing Council of the global Coalition for Disaster Resilient Infrastructure (CDRI).

- The Coalition is an India-led initiative to upgrade infrastructure from design, construction, operation and maintenance perspectives, and make renewable energy accessible and affordable.

- India and UNDRR, with the World Bank, the UN Development Programme (UNDP) and the Global Commission on Adaptation, have hosted two international workshops on disaster-resilient infrastructure in 2018 and 2019, respectively.

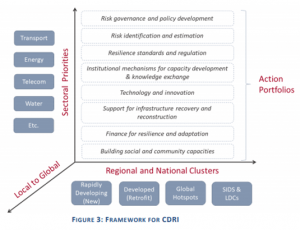

Eight thematic areas around which the CRDI could be developed

- These have been identified as ‘Action Portfolios’ in the diagram below.

- These portfolios are to be implemented within the three dimensions of scale, sector, and region.

India’s Zero Casualty Policy

- It refers to Indian Meteorological Department’s “almost pinpoint accuracy” of early warnings that helped authorities conduct a well-targeted evacuation plan and minimise the loss of life against extremely severe cyclonic storm Fani

- India’s zero casualty approach to managing extreme weather events is a major contribution to the implementation of the Sendai framework and the reduction of loss of life from such events.

Sendai Framework for Disaster Risk Reduction 2015-2030 was comprehensively covered in 15th Oct file.

Electoral Bonds

3. Deep Ocean Mission (TH)

- Context: India will soon launch an ambitious ‘Deep Ocean Mission’ that envisages exploration of minerals, energy and marine diversity of the underwater world

- The ‘Deep Ocean Mission (DOM)’ to be led by the Union Earth Sciences Ministry.

- The mission, which is expected to cost over ₹4,000 crore, will give a boost to efforts to explore India’s vast Exclusive Economic Zone and Continental Shelf

- A major thrust of the mission will be looking for metals and minerals.

Analysis

- India has been allotted a site of 75,000 sq. km. in the Central Indian Ocean Basin (CIOB) by the UN International Sea Bed Authority for exploitation of polymetallic nodules (PMN).

- These are rocks scattered on the seabed containing iron, manganese, nickel and cobalt.

- Being able to lay hands on even 10% of that reserve can meet the energy requirement for the next 100 years.

- It has been estimated that 380 million metric tonnes of polymetallic nodules are available at the bottom of the seas in the Central Indian Ocean.

- India’s Exclusive Economic Zone spreads over 2.2 million sq. km. and in the deep sea, lies “unexplored and unutilised”.

Polymetallic Nodules

- Of all the mineral resources considered as potential targets for deep-sea mining, polymetallic nodules (also commonly called manganese nodules) are probably the most likely commodity to be developed into a commercial operation.

- These are rounded accretions of manganese and iron hydroxides that cover vast areas of the seafloor, but are most abundant on abyssal plains at water depths of 4000-6500 metres.

- They range in size from a few millimeters to tens of centimeters.

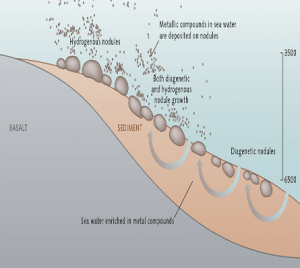

How do nodules grow?

- Manganese nodules grow when metal compounds dissolved in the water column (hydrogenous growth) or in water contained in the sediments (diagenetic growth) are deposited around a nucleus.

- Most nodules are a product of both diagenetic and hydrogenous growth.

- Growth of these nodules is extremely slow, at a rate of millimetres per million years, and they remain on the seafloor surface, often partially buried in a thin layer of sediment.

- This means that manganese nodules can only grow in areas where the environmental conditions remain stable over this kind of time scale.

The following factors are essential for the formation of manganese nodules:

- Low sedimentation rates of suspended material.

- Otherwise the nodules would be covered too rapidly;

- Constant flow of Antarctic bottom water.

- This water flushes fine sediment particles away that would otherwise bury the nodules over time.

- The coarser particles, such as the shells of small marine organisms and clam or nodule fragments, may be left behind to act as nuclei for new nodules;

- Good oxygen supply.

- The Antarctic bottom water, for example, transports oxygen-rich water from the sea surface to greater depths. Without this the manganese oxide compounds could not form;

- Aqueous sediment.

- The sediment has to be capable of holding large amounts of pore water.

- Diagenetic nodule growth can only take place in very aqueous sediments.

- Furthermore, some researchers hold the opinion that bottom-dwelling organisms such as worms that burrow around in the sediment must be present in large numbers in order to constantly push the manganese nodules up to the sediment surface.

- This hypothesis, however, has not yet been proven.

Composition

- The composition of nodules varies with their environment of formation, but in addition to manganese and iron, they can contain nickel, copper and cobalt in commercially attractive concentrations as well as traces of other valuable metals such as molybdenum, zirconium and Rare Earth Elements.

- In part, the manganese nodule deposits are of interest because they contain greater amounts of some metals than are found in today’s known economically minable deposits on land.

- Although the conditions for the formation of manganese nodules are the same in all four of the major regions, their metal contents vary from place to place.

Distribution

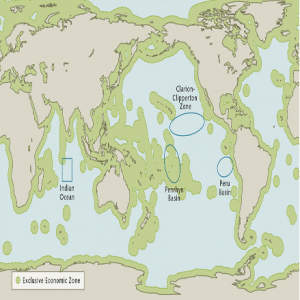

- Manganese nodules occur in all oceans. But only in 4 regions is the density of nodules great enough for industrial exploitation.

Clarion-Clipperton Zone (CCZ):

- With an area of around 9 million square kilometres, approximately the size of Europe, this is the world‘s largest manganese nodule region.

- The CCZ is located in the Pacific, extending from the west coast of Mexico to Hawaii.

- On the average, one square metre in the Clarion-Clipperton Zone contains around 15 kilograms of manganese nodules.

- The occurrences in the Clarion-Clipperton Zone (CCZ) alone hold around 10 times more manganese than the economically minable deposits on land today.

Peru Basin:

- The Peru Basin lies about 3000 kilometres off the Peruvian coast.

- It is about half as large as the Clarion-Clipperton Zone.

- The region contains an average of 10 kilograms of manganese nodules per square metre.

Penrhyn Basin:

- This also lies in the Pacific and is near the Cook Islands, a few thousand kilometres east of Australia.

- It has an area of around 750,000 square kilometres.

- The region contains an average of 25 kilograms of manganese nodules per square metre of sea floor.

Indian Ocean:

- So far only a single large area of manganese nodules has been discovered here, with an area comparable to that of the Penrhyn Basin.

- It is located in the central Indian Ocean.

- Each square metre of the sea floor here contains around 5 kilograms of manganese nodules.

- The International Seabed Authority (ISA), an autonomous international organisation established under the 1982 United Nations Convention on the Law of the Sea, allots the ‘area’ for deep-sea mining.

- India was the first country to receive the status of a ‘Pioneer Investor ‘ in 1987 and was given an area of about 1.5 lakh sq km in the Central Indian Ocean Basin (CIOB) for nodule exploration.

- In 2002, India signed a contract with the ISA and after complete resource analysis of the seabed 50% was surrendered and the country retained an area of 75,000 sq km.

Associated ecosystems

- The nodules provide a substrate for a wide variety of suspension feeders and specialised nodule epi- and in-fauna, which are dependent on the hard substrate provided by the nodules.

Who owns resources in the sea?

- The international Law of the Sea precisely regulates who can mine manganese nodules or massive sulphide and cobalt crusts in the future.

- If the resources are located within the Exclusive Economic Zone (EEZ) of a country, the so-called 200 nautical mile zone, this country has the sole right to mine them or to award mining licences to foreign companies.

- This is the case, for example, in a part of the Penrhyn Basin near the Cook Islands.

- The CCZ, the Peru Basin, and the Indian Ocean area, on the other hand, all lie far outside the Exclusive Economic Zones, in the realm of the high seas.

- Here, mining is centrally regulated by an agency of the United Nations, the International Seabed Authority (ISA), with headquarters in Kingston, Jamaica.

- In particular, the ISA ensures that the benefits from future activities related to marine mining are shared equitably and exclusive access to the promising resources in the deep sea by rich countries should be prevented.

- Its authority is based on various articles of the United Nations Convention on the Law of the Sea, which define the high seas as the common heritage of mankind.

- For the manganese nodule areas this means that contractors apply to the ISA for an exploration area of up to 150,000 square kilometres.

- The individual contractor must pay a licence fee for these areas.

- The crucial condition is that the countries can only use half of their licence area, or a maximum of 75,000 square kilometres.

- After preliminary exploration, the other half is reserved for developing states.

- So far the ISA has awarded 12 licences for the Clarion-Clipperton Zone and one for the Indian Ocean, all to various states.

Extraction

- There are two major hurdles:

- cheap availability of metals from more easily accessible land-based deposits.

- presence of numerous volcanic hills with a relief of about 100m which make the extraction of nodules extremely patchy.

The United Nations Convention on the Law of the Sea (UNCLOS)

- It is an international treaty which was adopted and signed in 1982.

- The Convention has created three new institutions on the international scene:

- the International Tribunal for the Law of the Sea,

- the International Seabed Authority,

- the Commission on the Limits of the Continental Shelf.

- It is an initiative of the Ministry of Earth Sciences to explore seabed resources and to improve India’s position in ocean research field.

- India’s exclusive rights to explore polymetallic nodules from seabed in Central Indian Ocean Basin (CIOB) were extended by further five years in 2017.

- These rights are over 75000 sq. km of area in international waters allocated by International Seabed Authority for developmental activities for polymetallic nodules.

- India is the first country to have received the status of a pioneer investor in 1987 and was allocated an exclusive area in Central Indian Ocean Basin by United Nations (UN) for exploration and utilization of nodules.

- International Seabed Authority (ISA) is a UN body set up to regulate the exploration and exploitation of marine non-living resources of oceans in international waters.

Polymetallic Nodules

- Of all the mineral resources considered as potential targets for deep-sea mining, polymetallic nodules (also commonly called manganese nodules) are probably the most likely commodity to be developed into a commercial operation.

Formation

- Polymetallic nodules are rounded accretions of manganese and iron hydroxides that cover vast areas of the seafloor, but are most abundant on abyssal plains at water depths of 4000-6500 metres.

- They range in size from a few millimeters to tens of centimeters.

- Growth of these nodules is extremely slow, at a rate of millimetres per million years, and they remain on the seafloor surface, often partially buried in a thin layer of sediment.

Composition

- The composition of nodules varies with their environment of formation, but in addition to manganese and iron, they can contain nickel, copper and cobalt in commercially attractive concentrations as well as traces of other valuable metals such as molybdenum, zirconium and Rare Earth Elements.

Distribution

- The nodules of greatest commercial interest occur in the Clarion-Clipperton Zone in the equatorial Pacific Ocean (CCZ) and in the Central Indian Ocean Basin.

Associated ecosystems

- The nodules provide a substrate for a wide variety of suspension feeders and specialised nodule epi- and infauna, which are dependent on the hard substrate provided by the nodules.

Extraction

- The concept of polymetallic nodules as a serious commercial prospect emerged in the 1960’s and 70’s, leading to a rush to develop the technology to extract them.

- However, the industry never developed due to the cheap availability of nickel from more easily accessible land-based deposits.

- For current mining scenarios, the mining process is predicted to disturb about 120 km2of seabed per year per mining operation and represents a major environmental impact.

- However, owing to the presence of numerous volcanic hills with a relief of about 100m the extraction of nodules will be extremely patchy.

4. Odisha tribe sees rise in migration (TH)

Context: Young people from the Bonda tribal group have been forced to leave their pristine hamlets for low-paid jobs in distant towns of Andhra Pradesh, Telangana and States even farther.

- The COVID-19 pandemic appears to have quickened the ‘distress’ migration— the Bondas, a particularly vulnerable tribal group in the hilly Malkangiri district of Odisha, known for their secluded lives away from the mainstream.

Analysis

Particularly Vulnerable Tribal Groups (PVTGs)

- Covered in detail Refer to 12th Nov 2020 file.

C) Polity/Governance

5. Electoral Bonds (TH)

- Context: Electoral bonds worth ₹282.29 crore were sold in October ahead of the Bihar Assembly election, the State Bank of India said on Friday in response to a Right to Information (RTI) query.

What are electoral bonds?

- Electoral bonds were announced in the Union Budget of 2017-18.

- The electoral bond scheme is being implemented by the Department of Economic Affairs, Ministry of Finance under the Reserve Bank of India Act, 1934.

- An electoral bond is a bearer instrument like a Promissory Note — in effect, it will be similar to a bank note that is payable to the bearer on demand and free of interest.

- A bearer instrument, or bearer bond, is a type of fixed-income security in which no ownership information is recorded and the security is issued in physical form to the purchaser.

- The holder is presumed to be the owner, and whoever is in possession of the physical bond is entitled to the coupon payments.

- Promissory Note is a signed document containing a written promise to pay a stated sum to a specified person or the bearer at a specified date or on demand.

- The bonds will be issued in multiples of ₹1,000, ₹10,000, ₹1 lakh, ₹10 lakh and ₹1 crore and will be available at specified branches of State Bank of India.

- SBI is the ‘Sole Authorized Bank’ by the Government of India for selling Electoral Bonds.

- The minimum amount for donation in Electoral Bonds is Rs 1000. There is no maximum limit for donation.

- Donors, with a KYC-compliant account, can donate the bonds to their party of choice which can then be cashed in via the party’s verified account within 15 days.

- The bonds do not bear the name of the donor, and the details are not made public.

What are the other conditions?

- Every party that is registered under section 29A of the Representation of the Peoples Act, 1951 and has secured at least one per cent of the votes polled in the most recent Lok Sabha or State election will be allotted a verified account by the Election Commission of India.

- Electoral bond transactions can be made only via this account.

- The bonds will be available for purchase for a period of 10 days each in the beginning of every quarter, i.e. in January, April, July and October as specified by the Central Government.

- An additional period of 30 days shall be specified by the Central Government in the year of Lok Sabha elections.

Who is eligible to donate through Electoral Bonds?

- The Electoral Bonds under this Scheme may be purchased by a Person, who is a Citizen of India or Incorporated or Established in India.

- The definition of “Person” includes-

- an Individual;

- a Hindu Undivided Family;

- a Company;

- a Firm;

- an Association of Persons or a Body of Individuals, whether incorporated or not;

- every Artificial Juridical Person, not falling within any of the preceding subclauses; and

- any Agency, Office or Branch owned or controlled by such person.

- Whether joint holding will be allowed? Electoral Bonds can be purchased either Singly or Jointly with other Individuals but not more than three Applicants per Application Form. No name(s) will be printed on the Bond.

- Can Electoral Bonds be purchased multiple times by same Applicant? Every application will be treated as fresh request for Electoral Bonds purchase and every time fresh KYC documents will be given.

- All payment for the issuance of the Electoral Bonds will be accepted in Indian Rupees only.

- Once the Electoral Bond is purchased it cannot be cancelled and no amount will be refunded to the Purchaser.

- Political Party cannot open more than one Current Account for Electoral Bond redemption.

- However, a Political Party can use this Current Account for other operations also.

- If the Political Party becomes de-notified before the next issuance of Electoral Bonds, then Bank will change the product code of their account to a regular Current Account code, so that Electoral Bonds cannot be deposited in the account.

- The electoral bonds will not bear the name of the donor. In essence, the donor and the party details will be available with the bank, but the political party might not be aware of who the donor is.

- The intention is to ensure that all the donations made to a party will be accounted for in the balance sheets without exposing the donor details to the public.

- The maximum amount of cash donation that a political party can receive is capped at ₹2,000 and that parties are entitled to receive donations by cheque or digital mode, in addition to electoral bonds.

Do you know?

- Data shows 99.9% of all electoral bonds bought so far are worth Rs 10 lakh or 1 crore.

- The bonds of Rs 1 crore are the most popular among all the electoral bond purchases so far.

- Before the introduction of the Scheme, cash donations of over Rs 20,000 could not be anonymous.

- The fact that donations through electoral bonds remain anonymous as well as tax exempt, and given most have been of high value, has raised concerns among experts.

- The amendment to Section 29C of the Representation of the People Act has made it no longer mandatory for the parties to report the details of donations received through the bonds.

RBI had warned of the pitfalls of electoral bonds

- The Reserve Bank of India (RBI) had advised the government that the electoral bonds it proposed in 2017 would not solve the problem of unaccounted-for money since the donor’s identity will be never be known.

- A person can buy these bonds from a know your customer compliant account from designated branches of the State Bank of India. These bonds are valid for 15 days.

- The problem with these instruments is that, while the information of the person who is buying the bond is known (to the bank), the donors’ identity is not known. This is because these are bearer bonds.

- A person who buys the bond, can give to it to another person who actually donates it to a political party, and there is no record of the person who takes it from the person who buys it.

- One hesitation RBI had was that it almost becomes currency. Because it is a bearer bond. So anybody can become its owner.

- The RBI said that the government’s proposal to enable scheduled banks to issue electoral bonds would result in multiple, non-sovereign entities being authorised to issue bearer instruments, which are currency-like instruments, which goes against the RBI’s sole authority to issue bearer instruments.

- The EC warned that this would allow illegal foreign funds to be routed to political parties.

- Objections were overruled and the scheme was passed in the Lok Sabha as part of the Finance Bill so that it would not have to go through the Rajya Sabha where the then-government lacked a majority.

- There is no other country in the world where such a scheme exists.

- The bank knows the purchaser of the bonds as well as the party that cashed it. The law agencies can obtain this information whenever they want. Can the ruling party use this to demand donations for itself, prevent donations to others, and use the law enforcement agencies to harass those who donate to rival parties? There is nothing in the electoral bonds scheme or existing laws to prevent this from happening.

- Equally troublesome, donation limits have been removed. In theory, a large corporate could buy the government using electoral bonds. This would not be possible in any other country.

- India continues to have spending limits but, as everyone knows, hardly any winning candidate sticks to it.

ECI’s reservations

- In Sep 2019, the Supreme Court passed interim directions, directing political parties to provide full information on each and every political donor and contributions made through electoral bonds in sealed cover to the Election Commission of India (ECI).

- In particular, the ECI, in its response filed in the court, said the provisions of the electoral bonds scheme (EBS)

- would enable the creation of shell companies for the sole purpose of making political donations and no other business,

- that the abolition of the clause that says firms must declare political contributions in their profit and loss accounts would compromise transparency, and

- the amendments to the law on foreign contributions would mean that there would be unchecked foreign funding of political parties, leading to foreign influence on India’s policy-making.

- Overall, it had recorded its unequivocal position that the EBS would help the use of black money for political funding.

Donations to National Parties

- As much as 67% of donations to national parties in 2018-19 came from “unknown sources,” an increase from 53% in the previous financial year, said a report released by the Association for Democratic Reforms.

While parties are required to give details of all donations above ₹20,000, donations under ₹20,000 and those via electoral bonds remain anonymous.