Are you an aspiring UPSC candidate with Commerce and Accountancy as your optional subject? If so, you will want to pay close attention to the blog post on Understanding Dividend Decisions: A Complete Guide. Dividend decisions play a crucial role in the financial management of businesses, and having a comprehensive understanding of this topic can give you a competitive edge in your exam preparation. In this blog, we will delve into the intricacies of dividend decisions, providing you with a thorough guide to help you master this important aspect of your syllabus. So, grab a notebook and get ready to enhance your knowledge on dividend decisions!

What Are Dividends?

First things first, let us understand what dividends are. Dividends are a portion of a company’s profits that are distributed to its shareholders. Imagine you own a piece of a company, and when that company makes money, they give you a little piece of that profit as a reward for being a shareholder. It’s like getting a bonus for being part of the company!

Why Do Companies Pay Dividends?

Now, you might be wondering why companies choose to pay dividends. Well, companies pay dividends to keep their shareholders happy and to reward them for investing in the company. It’s a way for companies to show appreciation to the people who believe in them and support their growth. So, when a company decides to pay dividends, it is like saying “thank you” to you as a shareholder.

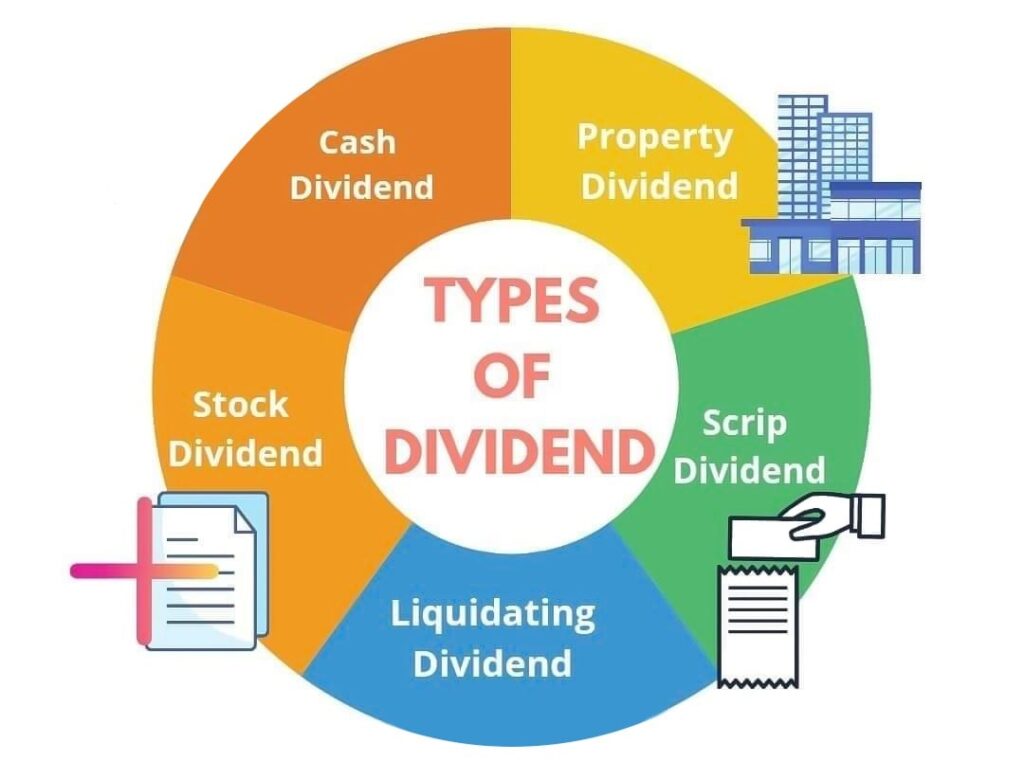

Types of Dividends

Dividends are a way for companies to reward their shareholders, sharing a portion of their profits with those who have invested in them. But not all dividends are the same! Let’s explore the different types of dividends that companies might distribute.

» Cash Dividends: The Classic Shareholder Reward

Cash dividends are the most common type of dividend. When a company is doing well and generating profits, it might decide to distribute a portion of those earnings directly to its shareholders in the form of cash dividends. This is essentially a way of saying “thank you” to the shareholders for their support and investment.

Here is how it works: For every share you own, the company pays you a certain amount of money. It is a straightforward and tangible way of receiving a return on your investment. For example, if you own 100 shares in a company that declares a cash dividend of Rs.2 per share, you would receive Rs.200. Cash dividends can be paid out quarterly, annually, or at other intervals, depending on the company’s policy.

» Stock Dividends: Growing Your Ownership

Stock dividends offer a different kind of benefit. Instead of receiving cash, shareholders are given additional shares of the company’s stock. This means that instead of getting a direct cash payment, you now own more shares in the company, increasing your total ownership stake.

For instance, if a company declares a 5% stock dividend and you own 100 shares, you would receive an additional 5 shares, bringing your total to 105 shares. Stock dividends are often used by companies that want to reward shareholders without reducing their cash reserves. They are particularly attractive in growth-oriented companies where retaining cash for reinvestment is a priority.

» Special Dividends: The Unexpected Bonus

Special dividends are a bit of a wildcard in the dividend world. Unlike regular cash or stock dividends, special dividends are one-time payments that a company might make when it has excess profits or cash on hand. They are not a regular part of a company’s dividend schedule, making them a pleasant surprise for shareholders.

For example, a company might sell a significant asset or experience an exceptionally profitable year and decide to share some of that windfall with its shareholders through a special dividend. These dividends can be substantial and are often seen as a sign of the company’s strong financial health.

» Why Dividends Matter to Investors

Understanding the different types of dividends is essential for investors who are looking to maximize their returns. Whether it’s the regular income from cash dividends, the potential for growth through stock dividends, or the occasional windfall from special dividends, each type offers its own benefits and can play a critical role in an investor’s portfolio strategy.

Pro Tip: Reinvesting dividends, whether they are cash or stock dividends, can significantly boost your long-term returns. Many investors use a Dividend Reinvestment Plan (DRIP) to automatically reinvest their dividends into additional shares, compounding their investment over time.

Dividend Policies

Dividend policies are the set of guidelines that a company follows to determine how much they should pay out to their shareholders as dividends. These policies are crucial in maintaining a balance between rewarding shareholders and reinvesting profits back into the business for future growth.

Stable Dividend Policy

A stable dividend policy is when a company commits to paying out a consistent amount of dividends to its shareholders regularly. This type of policy is favored by investors who rely on dividend income as a source of passive income. Companies with stable dividend policies aim to provide investors with a predictable and reliable stream of income.

Residual Dividend Policy

The residual dividend policy is based on the idea that dividends should be paid from the residual or leftover earnings after all profitable investment opportunities have been funded. This policy ensures that the company first reinvests in projects that will generate the highest returns before distributing any remaining profits to shareholders as dividends.

Hybrid Dividend Policy

A hybrid dividend policy is a combination of both stable and residual dividend policies. Companies following a hybrid policy consider both the need to maintain a consistent dividend payout for investors and the importance of reinvesting in the business for future growth. This approach allows companies to strike a balance between rewarding shareholders and funding new projects.

Factors Influencing Dividend Decisions

When companies make decisions about paying dividends to their shareholders, there are several factors they consider. These factors play a crucial role in determining how much, if any, dividends will be distributed. Let’s take a look at some of the key factors that influence dividend decisions.

Company Profits

One of the most significant factors that influence dividend decisions is the company’s profits. Companies need to have sufficient profits to be able to pay dividends to their shareholders. If a company is not making enough money, it may not be able to afford to distribute dividends. Shareholders rely on a company’s profitability to receive dividends as a return on their investment.

Investment Opportunities

Another important factor that can influence dividend decisions is the availability of new investment opportunities. Companies may choose to reinvest their profits into new projects or ventures instead of paying them out as dividends. By investing in growth opportunities, companies aim to increase their long-term value, which can benefit shareholders in the future.

Market Conditions

The overall market conditions also play a role in influencing dividend decisions. Companies may adjust their dividend payments based on economic trends, industry performance, and other external factors. During times of economic uncertainty or market volatility, companies may choose to conserve cash and reduce dividend payments to ensure financial stability.

Conclusion

In conclusion, understanding dividend decisions is crucial for young investors looking to grow their wealth. By grasping the concept of dividends, the types of dividends, dividend policies, and the factors that influence dividend decisions, investors can make informed choices when investing in companies.

Main Points Recap

We have discussed what dividends are, why companies pay dividends, the different types of dividends such as cash dividends, stock dividends, and special dividends, as well as the various dividend policies including stable, residual, and hybrid policies. Furthermore, we explored the factors that influence dividend decisions, such as company profits, investment opportunities, and market conditions.

Importance of Dividend Understanding

By understanding dividend decisions, young investors can make informed choices about which companies to invest in based on their dividend policies and history. Dividends can provide a steady stream of income and signal a company’s financial stability and growth potential. Therefore, it is essential for investors to consider dividends as part of their investment strategy.