Indian Accounting Standards have become a critical aspect of financial reporting in India. As the country aims to align itself with global reporting practices the need for a comprehensive framework that ensures transparency and comparability has become evident. In this article, we will delve into the need, benefits, limitations, and applicability of Indian Accounting Standards.

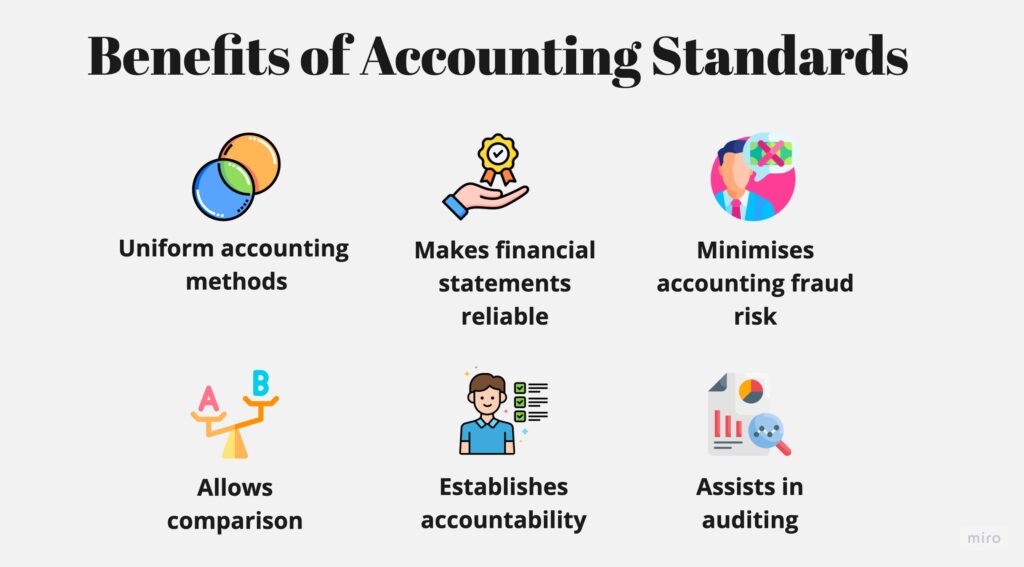

Implementing Indian Accounting Standards offers various benefits to both companies and stakeholders. It enhances the credibility and reliability of financial statements, making them more useful for decision-making. Standardizing accounting practices also facilitates easier comparison between companies, industries, and countries. Moreover, adherence to these standards improves communication between management, investors, creditors, and other interested parties.

However, Indian Accounting Standards have their limitations. They require proper interpretation and application, which can be challenging due to their complexity. Additionally, companies need to invest resources in training and upskilling their employees to comply with the standards.

Understanding the need, benefits, limitations, and applicability of Indian Accounting Standards is crucial for a UPSC aspirant with Commerce and Accountancy as optional paper in UPSC mains exam. By embracing these standards, businesses and stakeholders can enhance transparency, comparability, and trust in financial reporting practices.

List of Accounting standards issued by ICAI

| Accounting Standard | Description | Applicable To Level |

|---|---|---|

| AS1 | Disclosure of Accounting Policies | All |

| AS2 | Valuation of Inventories | All |

| AS3 | Cash Flow Statements | 1 |

| AS4 | Contingencies and Events Occurring After the Balance Sheet Date | All |

| AS5 | Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies | All |

| AS6 (withdrawn FY 2016-17) | Depreciation Accounting | —– |

| AS7 | Construction Contracts | All |

| AS8 | Accounting for Research and Development | All |

| AS9 | Revenue Recognition | All |

| AS10 | Accounting for Fixed Assets | All |

| AS11 | The Effects of Changes in Foreign Exchange Rates | All |

| AS12 | Accounting for Government Grants | All |

| AS13 | Accounting for Investments | All |

| AS14 | Accounting for Amalgamations | All |

| AS15 | Accounting for Retirement Benefits in the Financial Statements of Employers | All |

| AS16 | Borrowing Costs | All |

| AS17 | Segment Reporting | 1 |

| AS18 | Related Party Disclosures | 1 |

| AS19 | Leases | All |

| AS20 | Earnings Per Share | All |

| AS21 | Consolidated Financial Statements | See Note |

| AS22 | Accounting for Taxes on Income | All |

| AS23 | Accounting for Investments in Associates in Consolidated Financial Statements | See Note |

| AS24 | Discontinuing Operations | 1,2 |

| AS25 | Interim Financial Reporting | All |

| AS26 | Intangible Assets | All |

| AS27 | Financial Reporting of Interests in Joint Ventures | See Note |

| AS28 | Impairment of Assets | All |

| AS29 | Provisions, Contingent Liabilities and Contingent Assets | All |

Note: AS 21, AS 23 and AS 27 for the preparation of consolidated financial statements are required to be complied with by a non-corporate entity if the non-corporate entity voluntarily prepares and presents the consolidated financial statements.

Need for Indian Accounting Standards

The need for Indian Accounting Standards arises from the desire to establish a robust financial reporting framework that meets the requirements of a growing economy. Prior to the adoption of these standards, India followed its own Generally Accepted Accounting Principles (GAAP), which lacked uniformity and comparability with international practices. This created challenges for companies operating globally and hindered foreign investment.

The adoption of Indian Accounting Standards, also known as Ind AS, was driven by the need to enhance transparency, accountability, and credibility in financial reporting. These standards align with the International Financial Reporting Standards (IFRS), making it easier for Indian companies to compete on a global scale. They also provide a common language for financial reporting, facilitating easier comparison between companies, industries, and countries.

Indian Accounting Standards address the complexities of diverse industries, such as banking, insurance, and infrastructure, and provide guidance on specific issues relevant to these sectors. This ensures that financial statements reflect the economic reality of these industries and enables stakeholders to make informed decisions.

Benefits of adopting Indian Accounting Standards

Implementing Indian Accounting Standards offers various benefits to both companies and stakeholders. One of the primary benefits is the enhanced credibility and reliability of financial statements. Adherence to these standards ensures that financial information is presented accurately, providing a true and fair view of a company’s performance. This, in turn, increases investor confidence and attracts foreign investment.

Standardizing accounting practices through Indian Accounting Standards also facilitates easier comparison between companies. Investors can evaluate the financial performance of different companies within the same industry, enabling them to make informed investment decisions. It also allows for better comparison between Indian companies and their global counterparts, promoting transparency and competitiveness.

Moreover, adherence to Indian Accounting Standards improves communication between management, investors, creditors, and other interested parties. The standardized reporting framework enables stakeholders to understand and analyze financial information more effectively. This leads to improved decision-making, as stakeholders can assess the financial health and performance of a company more accurately.

Limitations of Indian Accounting Standards

Complexity: Indian Accounting Standards are complex and require careful interpretation and application.

- This complexity can lead to inconsistent interpretations and potential misapplication.

- It may affect the comparability and reliability of financial statements.

Cost of Implementation: Implementing and complying with these standards can be costly.

- Companies need to invest in training and upskilling employees.

- This is a significant financial burden, especially for smaller companies with limited resources.

Industry-specific Challenges: Some industries have unique transactions or reporting needs.

- Indian Accounting Standards may not fully address these specific requirements.

- Companies in these industries may need additional guidance or interpretations for accurate reporting.

Applicability of Indian Accounting Standards

Indian Accounting Standards are applicable to all companies in India, with some exceptions. Listed companies, companies with a net worth of ₹500 crores or more, and companies whose securities are listed or in the process of being listed on stock exchanges outside India are required to comply with Indian Accounting Standards. The applicability also extends to banks, insurance companies, and non-banking financial companies.

For companies that do not fall under the mandatory applicability criteria, the Ministry of Corporate Affairs (MCA) has provided an option to voluntarily adopt Indian Accounting Standards. This allows companies to benefit from the advantages of standardized reporting and better comparability, even if they are not legally required to comply.

It is important for companies to be aware of the applicability criteria and ensure timely compliance with Indian Accounting Standards. Non-compliance can result in penalties and legal consequences, impacting a company’s reputation and credibility.

Key differences between Indian Accounting Standards and International Financial Reporting Standards (IFRS)

While Indian Accounting Standards are largely aligned with IFRS, there are some key differences between the two frameworks. These differences arise due to specific requirements and considerations applicable to the Indian context. Some of the key differences include:

- Treatment of certain transactions: Indian Accounting Standards may have specific requirements for certain transactions that differ from IFRS. For example, the treatment of leases and revenue recognition may have some variations.

- Timing of adoption: Indian Accounting Standards may adopt new or revised standards at a different pace compared to IFRS. This can result in temporary differences in reporting requirements between the two frameworks.

- Level of detail: Indian Accounting Standards may provide additional guidance or explanations to address specific reporting challenges in the Indian context. This can result in differences in the level of detail provided in the standards compared to IFRS.

It is important for companies to be aware of these differences and ensure compliance with the specific requirements of Indian Accounting Standards.

Steps to implement Indian Accounting Standards in your organization

Implementing Indian Accounting Standards in an organization requires careful planning and execution. Here are some steps that can help facilitate a smooth transition:

- Awareness and understanding: Start by creating awareness among key stakeholders about the need for Indian Accounting Standards and the benefits of adoption. Ensure that the management and finance teams have a clear understanding of the requirements and implications.

- Gap analysis: Conduct a comprehensive gap analysis to identify the differences between the company’s existing accounting practices and the requirements of Indian Accounting Standards. This will help determine the extent of changes required and the resources needed for implementation.

- Training and upskilling: Provide training and upskilling opportunities to finance and accounting teams to ensure a thorough understanding of Indian Accounting Standards. This may involve workshops, seminars, and online courses to enhance knowledge and expertise.

- Review and update accounting policies: Review existing accounting policies and align them with the requirements of Indian Accounting Standards. Identify areas where changes are needed and update policies accordingly.

- System and process changes: Assess the impact of Indian Accounting Standards on existing systems and processes. Make necessary changes to ensure compliance and accurate reporting.

- Testing and validation: Conduct rigorous testing and validation of financial statements prepared under Indian Accounting Standards. This will help identify any errors or inconsistencies and ensure the accuracy and reliability of the reporting.

- Continuous monitoring and updates: Stay updated on any revisions or new standards issued by the Ministry of Corporate Affairs. Regularly monitor changes and ensure timely compliance with any updates.

By following these steps, organizations can successfully implement Indian Accounting Standards and benefit from enhanced transparency and comparability in financial reporting.

Challenges in implementing Indian Accounting Standards

Implementing Indian Accounting Standards can pose several challenges for organizations. Some of the key challenges include:

- Complexity: Indian Accounting Standards can be complex and require a deep understanding of accounting principles. Companies may struggle to interpret and apply the standards correctly, leading to potential errors or misstatements in financial reporting.

- Resource constraints: Smaller companies may face resource constraints, making it challenging to allocate sufficient time and resources for training and implementation. Limited access to expert guidance and training materials can hinder the adoption process.

- System and process changes: Implementing Indian Accounting Standards may require changes to existing systems, processes, and reporting templates. This can be time-consuming and may require significant investment in IT infrastructure.

- Change management: Transitioning to new accounting standards requires change management efforts to ensure smooth adoption. Resistance to change, lack of awareness, and the need for cultural shifts within the organization can pose challenges.

- Industry-specific requirements: Some industries may have unique reporting requirements that are not adequately addressed by Indian Accounting Standards. Companies operating in these industries may need to rely on additional guidance or interpretations.

It is important for organizations to be aware of these challenges and proactively address them through proper planning, resource allocation, and training.

Resources for learning and staying updated on Indian Accounting Standards

To stay updated on Indian Accounting Standards and enhance knowledge in this area, professionals can leverage various resources. Some of the key resources include:

- Ministry of Corporate Affairs (MCA) website: The MCA website provides access to the latest Indian Accounting Standards, notifications, and circulars. It is a valuable source of information for understanding the requirements and updates.

- Professional accounting bodies: Bodies such as the Institute of Chartered Accountants of India (ICAI) and the Institute of Cost Accountants of India (ICMAI) offer training programs, webinars, and publications on Indian Accounting Standards. They also provide technical guidance and interpretations.

- Accounting and auditing firms: Consulting firms specializing in accounting and auditing can provide training, guidance, and assistance in implementing Indian Accounting Standards. They often publish articles, newsletters, and updates on relevant topics.

- Industry associations and forums: Industry associations and forums often organize seminars, conferences, and panel discussions on accounting standards. These events provide an opportunity to learn from experts and network with peers.

- Online courses and educational platforms: Various online platforms offer courses and modules on Indian Accounting Standards. These courses can be accessed at one’s own pace and provide a flexible learning option.

By utilizing these resources, professionals can stay updated on Indian Accounting Standards and enhance their understanding and expertise in this area.

Let's Connect

Conclusion

Understanding the need, benefits, limitations, and applicability of Indian Accounting Standards is crucial for professionals in the financial sector. By embracing these standards, businesses and stakeholders can enhance transparency, comparability, and trust in financial reporting practices. While the adoption of Indian Accounting Standards may pose challenges, the long-term benefits in terms of credibility, investor confidence, and global competitiveness outweigh the initial difficulties. With proper planning, training, and compliance, companies can successfully implement Indian Accounting Standards and contribute to a stronger financial reporting ecosystem in India.

FAQs

Currently, MCA has notified 40 Indian Accounting Standards (Ind AS), with one standard, Ind AS 11, not being applicable to companies.

AS 3 does not give guidance specifically to deal with preparation and presentation of consolidated cash flow statement. Ind-AS 7 deals with Guidance on preparation and presentation of consolidated cash flow statements.

Yes, accounting standards are necessary. They provide guidelines and rules that companies must follow when preparing their financial statements. These standards ensure consistency, transparency, and comparability in financial reporting. By following these standards, investors, regulators, and other stakeholders can make informed decisions about the financial health and performance of a company.