UPSC PRELIMS+MAINS

A) Science and Technology/Defence/Space

-

Pact inked to develop virus antibodies (TH)

Context: The Serum Institute of India (SII), along with the International AIDS Vaccine Initiative (IAVI), a non-profit scientific research organisation, on Thursday announced an agreement with pharmaceutical major Merck to develop SARS-CoV-2 neutralising monoclonal antibodies.

- Using monoclonal antibodies (mAbs or Moabs) against SARS-CoV-2 are widely considered to be promising candidates for Covid-19 treatment and prevention.

Analysis

International AIDS Vaccine Initiative (IAVI)

- IAVI is a nonprofit scientific research organization dedicated to addressing urgent, unmet global health challenges including HIV and tuberculosis.

- Its mission is to translate scientific discoveries into affordable, globally accessible public health solutions.

- Through scientific and clinical research in Africa, India, Europe, and the U.S., IAVI is pioneering the development of biomedical innovations designed for broad global access.

- It is also developing vaccines and antibodies in and for the developing world and seek to accelerate their introduction in low-income countries.

- IAVI accelerates scientific discovery and development by fostering unique collaborations among academia, industry, local communities, governments, and funders to explore new and better ways to address public health threats that disproportionately affect people living in poverty.

Monoclonal antibodies (mAbs or Moabs)

- Monoclonal antibodies are man-made proteins that act like human antibodies in the immune system.

- One way the body’s immune system attacks foreign substances is by making large numbers of antibodies.

- An antibody is a protein that sticks to a specific protein called an antigen.

- Antibodies circulate throughout the body until they find and attach to the antigen.

- Once attached, they can force other parts of the immune system to destroy the cells containing the antigen.

- Researchers can design antibodies that specifically target a certain antigen, such as one found on cancer cells or COVID-19 virus.

- They can then make many copies of that antibody in the lab. These are known as monoclonal antibodies(mAbs or Moabs).

- Monoclonal antibodies (mAbs) are used to treat many diseases, including some types of cancer.

- Some mAbs have no drug or radioactive material attached to them. They work by themselves.

- Some boost a person’s immune response against cancer cells by attaching to them and acting as a marker for the body’s immune system to destroy them.

- Some mAbs boost the immune response by targeting the immune system checkpoints.

- Other mAbs work mainly by attaching to and blocking antigens on cancer cells (or other nearby cells) that help cancer cells grow or spread.

- Monoclonal antibodies are used to treat many diseases, including some types of cancer. To make a monoclonal antibody, researchers first have to identify the right antigen to attack.

What mAbs are made of?

- Monoclonal antibodies are man-made proteins that act like human antibodies in the immune system. There are 4 different ways they can be made and are named based on what they are made of.

- Murine: These are made from mouse proteins and the names of the treatments end in -omab.

- Chimeric: These proteins are a combination of part mouse and part human and the names of the treatments end in -ximab.

- Humanized: These are made from small parts of mouse proteins attached to human proteins and the names of the treatments end in -zumab

- Human: These are fully human proteins and the names of the treatments end in -umab.

Possible side effects of monoclonal antibodies

- Monoclonal antibodies are given intravenously (injected into a vein).

- The antibodies themselves are proteins, so giving them can sometimes cause an allergic reaction.

-

Soil-Transmitted Helminthiases (STH) (TH)

- Context: Health Ministry has said that 14 States have reported reduction in prevalence of parasitic intestinal worm infection also known as Soil-Transmitted Helminthiases (STH) — or roundworms.

Analysis

- Soil-Transmitted Helminthiases is a significant public health concern mostly in low resource settings.

- These are known to have detrimental effects on children’s physical growth and well-being and can cause anemia and under-nutrition.

- Because of the pronounced impact on child growth and development, the 54th World Health Assembly, in 2011, committed itself to reducing the prevalence and the intensity of soil-transmitted helminth infections in all countries by 50%.

- India accounts for a quarter of the world’s STH-infected children; 64% of them are younger than 14 years.

- Since its launch in 2015 under the National Health Mission, the National Deworming Day (NDD), a flagship program of the Ministry of Health and Family Welfare, is run as a biannual single day programme implemented through the platforms of schools and anganwadis.

- Under the programme, Albendazole tablet, approved by World Health Organization is used for treatment of intestinal worms in children and adolescents as part of Mass Drug Administration (MDA) programmes globally.

- The National Centre for Disease Control (NCDC) completed the baseline STH mapping across the country by the end of 2016.

- The data showed varied prevalence ranging from 12.5 per cent in Madhya Pradesh to 85 per cent in Tamil Nadu.

- Open defecation, contaminated soil and water, uncooked food, and not following basic hygiene are the main reasons for transmission (worm larvae and eggs).

- If undiagnosed, worms persist in the body and lay thousands of eggs every day.

- Worms cause a decline in iron, protein and vitamin A levels, leading to anaemia, a lower appetite, malnutrition, and diarrhoea.

- Since eradication of STH infections is difficult, given its faeco-oral and penetration-via-skin transmission patterns, the chances of re-infection are very high in population living in endemic areas.

- This is particularly a concern in regions with tropical climate with high humidity and warm temperatures such as Tamil Nadu, Andhra Pradesh, Bihar, Assam, and West Bengal and in cities that have seen unplanned urbanisation.

-

Stand-off Anti-tank Missile (SANT) (IE)

- Context: The Defence Research and Development Organisation (DRDO) is developing a new air-launched missile capable of knocking out enemy tanks from a stand-off distance of more than 10km.

Analysis

- The indigenous missile — named stand-off anti-tank missile (SANT) — is expected to be mated to the Indian Air Force’s Russian-origin Mi-35 attack helicopters to arm them with the capability to destroy enemy armour from an improved stand-off range.

- The existing Russian-origin Shturm missile on the Mi-35 can target tanks at a range of 5km.

- If the helicopter can engage enemy armour from a distance of 10km, it is unlikely to take a hit from ground fire

- The missile will have lock-on after launch and lock-on before launch capability.

- A lock-on means the target has been detected and the missile will hit it irrespective of any change in the target’s position.

- The existing anti-tank missiles developed by DRDO — the Nag and Helina –– have an effective range of under 5km.

- While the Nag missile is launched from a modified infantry combat vehicle (called the Nag missile carrier or Namica) and has a range of 4km, the Helina or helicopter-based Nag is for mounting on the Dhruv advanced light helicopter and can strike targets up to 5km away.

- The key tests recently conducted by India include the supersonic missile-assisted release of torpedo (SMART) to target submarines at long ranges, a new version of the nuclear-capable hypersonic Shaurya missile with a range of 750km and the anti-radiation missile RUDRAM to take down enemy radars and surveillance systems.

- In early September, DRDO carried out a successful flight test of the hypersonic technology demonstrator vehicle (HSTDV) for the first time from a launch facility off the Odisha coast.

- Only the United States, Russia and China have developed technologies to field fast-manoeuvring hypersonic missiles that fly at lower altitudes and are extremely hard to track and intercept.

-

Bandicoot robot (IE)

- Context: In order to improve the working of sanitation workers, the Greater Mohali Area Development Authority (GMADA) has introduced the work of cleaning manholes in the city with the help of a bandicoot robot, thus replacing the manual cleaning.

Analysis

- The bandicoot robot could do every work that a sanitation worker performs inside the manhole.

- It is the world’s first manhole-cleaning robot developed under the “Make in India” and ‘Swachh Bharat’ initiative by a start-up Indian company, Genrobotics.

- The robot could clean manholes more efficiently and effectively than manual cleaning.

- The bandicoot robot can enter into the unseen depths of manholes and pull out solid waste material with its specially designed human comparable robotic arm and unclog the sewer system.

-

NAG Anti-Tank Guided Missile (PIB)

- Context: Final user trial of 3rd generation Anti-Tank Guided Missile (ATGM) NAG was carried out.

- This was launched from NAG Missile Carrier NAMICA.

Analysis

- NAG: This Anti Tank Guided Missile (ATGM) has been developed by DRDO to engage highly fortified enemy tanks in day and night conditions.

- The missile has “Fire & Forget” & “Top Attack” capabilities.

- Fire and forget means the missile guidance does not require further guidance after the launch and still hit the target without the launcher being in line-of-sight of the target.

- The top attack mode is selected against tanks, in which case the missile climbs above and strikes down on the target to penetrate the roof of the tank where there is the least armour protection.

- It uses the lock-on before launch system where the target is identified and designated before the weapon is launched (Fire & Forget)

- It is developed under the Integrated Guided Missile Development Programme (IGMDP).

- Nag can be launched from land and air-based platforms.

- The land-based platform is the Nag missile carrier (NAMICA).

- Air based platform is the helicopter-launched version designated as helicopter-launched NAG (HELINA).

B) Indices/Committees/Reports/Organisations

6.State of Global Air 2020 Report released (DTE)

- Context: India recorded the highest annual average PM 2.5 concentration exposure in the world last year, according to the State of Global Air 2020 (SOGA 2020) report released recently.

Analysis

- India was followed by Nepal, Niger, Qatar and Nigeria in high PM 2.5 exposures.

- The report also said that India has been recording an increase in PM 2.5 pollution since 2010 contrary to Centre’s claims that annual air pollution levels in the country are coming down.

- Out of the 20 most populous countries, 14 have recorded a gradual improvement in air quality but India, Bangladesh, Niger, Pakistan and Japan are among those that have recorded a modest increase in air pollution levels.

- SOGA, released by US-based Health Effects Institute and Global Burden of Disease (GBD), uses both data from ground monitors and satellite to make their assessments.

- To estimate the annual average PM2.5 exposure, or concentrations, GBD scientists link the concentrations in each block (they divide the globe in blocks or grids) with the number of people living within each block to produce a population weighted annual average concentration.

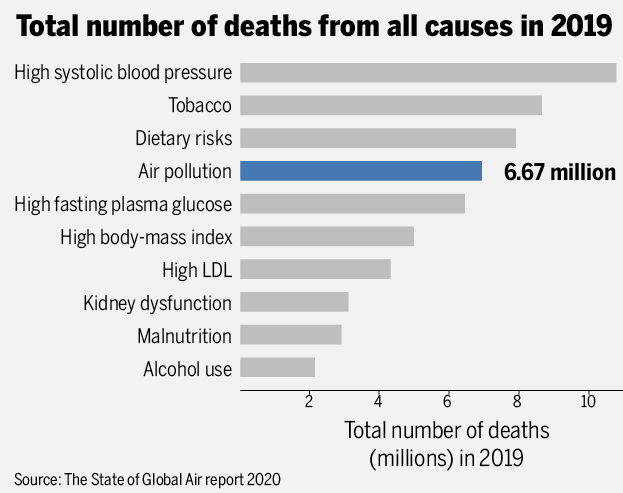

- Out of 87 health risk factors based on total number of deaths caused in 2019 assessed by the team, air pollution has the fourth highest risk globally preceded by high systolic blood pressure, tobacco and dietary risks.

- But in India, air pollution is the highest risk factor because of the huge burden of premature deaths it contributes to.

- India is also among the top ten countries with highest ozone (O3) exposure in 2019.

- Qatar recorded the highest O3 exposure followed by Nepal and India.

- Among the 20 most populous countries, India recorded the highest increase (17%) in O3 concentrations in the past ten years.

- On average, global exposure to ozone increased from about 47.3 parts per billion (ppb) in 2010 to 49.5 ppb in 2019.

- O3 is a major respiratory irritant which is not released directly into the air but is formed in a complex chemical interaction between nitrogen oxides (NOx) and volatile organic compounds (VOCs) in the presence of sunlight.

- NOx is emitted from the burning of fossil fuels (oil, gas, and coal) in motor vehicles, power plants, industrial boilers, and home heating systems.

- Volatile organic compounds are also emitted by motor vehicles, as well as by oil and gas extraction and processing and other industrial activities.

- The only silver lining for India though is that it has managed to reduce the number of people exposed to household air pollution.

- China reduced the percentage of its population exposed to household air pollution from 54% to 36%, while India reduced its percentage from 73% to 61% over the decade.

- Long-term exposure to outdoor and household air pollution contributed to over 1.67 million annual deaths from stroke, heart attack, diabetes, lung cancer, chronic lung diseases and neonatal diseases in India in 2019, according to the State of Global Air 2020.

- The National Clean Air Program should be expanded beyond the urban centres with an air-shed approach prioritising the local and regional mitigation measures to achieve clean air goals for India.

C) Polity/Bills/Acts/Judgments

7.Foreign funds & NGOs (TH)

- Context: The UN high commissioner for human rights has expressed concern that the Foreign Contribution Regulation Act (FCRA) was “being used to deter or punish NGOs for human rights reporting and advocacy” that was critical of the government.

- India is a party to the UN Human Rights Committee which oversees the implementation of the International Covenant on Civil and Political Rights.

Analysis

The Foreign Contribution (Regulation) Act (FCRA)

- The FCRA is applicable to all associations, groups and NGOs which intend to receive foreign donations.

- Under the Act, both the NGOs and the donors can be placed on a ‘watch list’ or in the ‘prior permission’ category, barring them from sending money to associations without the MHA’s clearance.

- Any NGO or association that intends to receive foreign funds has to compulsorily register under the Foreign Contribution Regulation Act (FCRA), monitored by the Ministry of Home Affairs (MHA).

- Registered NGOs can receive foreign contribution for five purposes — social, educational, religious, economic and cultural.

- All the members and office bearers of an NGO will have to file an affidavit making it mandatory for it to report “any violation” of the FCRA provisions by the applicant organisation.

- Filing of annual returns, on the lines of Income Tax, is compulsory.

- NGOs are required to give an undertaking that the acceptance of foreign funds is not likely to prejudicially affect the sovereignty and integrity of India or impact friendly relations with any foreign state and does not disrupt communal harmony.

- The Foreign Contribution (Regulation) Amendment Act, 2020 has amended the Foreign Contribution (Regulation) Act, 2010.

- It extends to the whole of India, and it shall also apply to—

- (a) citizens of India outside India; and

- (b) associate branches or subsidiaries, outside India, of companies or bodies corporate, registered or incorporated in India.

- Every person who has been granted a certificate or given prior permission shall receive foreign contribution in a single account only through such one of the branches of a bank.

- No funds other than foreign contribution shall be received or deposited in such account or accounts.

- However, such person may open one or more accounts in one or more banks for utilising the foreign contribution received by him.

Who can accept Foreign Contribution?

- Organizations working for definite cultural, social, economic, educational or religious programs can accept foreign contribution but first, they’ve to get permission from the Ministry of Home Affairs.

- They also have to maintain a separate account book listing the donation received from foreigners and get it audited by a Chartered Accountant and submit it to Home Ministry every year.

Prohibition to accept foreign contribution.

- No foreign contribution shall be accepted by any—

- (a) candidate for election;

- (b) correspondent, columnist, cartoonist, editor, owner, printer or publisher of a registered newspaper;

- (c) Judge, Government servant or employee of any corporation or any other body controlled or owned by the Government, public servants (as defined under the Indian Penal Code; added by the amendment in 2020);

- (d) member of any Legislature;

- (e) political party or office-bearer thereof (this provision has been amended);

- (f) organisation of a political nature;

- (g) association or company engaged in the production or broadcast of audio news or audio-visual news or current affairs programmes through any electronic mode.

- However, in 2017 the Ministry of Home Affairs, through the Finance Bill route, amended the 1976-repealed FCRA law paving the way for political parties to receive funds from the Indian subsidiary of a foreign company or a foreign company in which an Indian holds 50% or more shares.

- Foreign contribution shall be utilized for the purpose for which it has been received and such contribution can be used for administrative expenses up to 20% of such contribution received in a financial year.

Why is FCRN Act in news in the recent past?

- The government has amended (retrospectively) the FCRA, allowing foreign-origin companies to finance non-governmental organisations and thus political parties by changing the definition of “foreign companies”.

- Political parties in India can receive political donations from Indians living abroad as well as foreign companies with subsidiaries in India.

- Any foreign company can donate any amount of money to Indian political parties through their subsidiaries in India by purchasing electoral bonds.

- Electoral bonds are promissory notes that can be encashed by a registered political party through a designated bank account.

- Bonds would allow anonymous, digital donations to parties.

Prohibition to accept foreign contribution

- Under the 2010 Act, certain persons are prohibited to accept any foreign contribution. These include: election candidates, editor or publisher of a newspaper, judges, government servants, members of any legislature, and political parties, among others.

- The Amendment Act added public servants (as defined under the Indian Penal Code) to this list.

Transfer of foreign contribution

- Under the earlier 2010 Act, foreign contribution cannot be transferred to any other person unless such person is also registered to accept foreign contribution (or has obtained prior permission under the Act to obtain foreign contribution).

- The 2020 amendment has amended this to prohibit the transfer of foreign contribution to any other person.

- The term ‘person’ under the Act includes an individual, an association, or a registered company.

Aadhaar for registration

- The Amendment Act added that any person seeking prior permission, registration or renewal of registration must provide the Aadhaar number of all its office bearers, directors or key functionaries, as an identification document.

- The Amendment Act has also reduced the use of foreign contribution for administrative purposes to 20% from 50% earlier.

Single SBI branch for all FCRA accounts: Oct 2020

- The Union Home Ministry has asked all NGOs seeking foreign donations to open a designated FCRA account at the State Bank of India’s New Delhi branch by March 31, 2021.

- The Ministry’s order reiterated that NGOs registered under FCRA shall not receive any foreign donations in any other bank account from April 1, 2021.

- In September, the Foreign Contribution (Regulation) Act, 2020 was amended by Parliament and a new provision that makes it mandatory for all non-government organisations and associations to receive foreign funds in a designated bank account at SBI’s New Delhi branch was inserted.

- The order said an NGO will have to report the amount and source of foreign remittance received to the authorities.

D) Economy

8.Trade Facilitation Agreement (TFA) (TH)

- Context: India has opposed suggestions made by the US, Brazil and Colombia at the World Trade Organisation (WTO) of placing binding commitments on members for early implementation of provisions under the Trade Facilitation Agreement (TFA) at the time of the ongoing Covid-19 pandemic.

Analysis

- At the WTO meeting on trade facilitation, the US, Brazil and Colombia, later joined by Japan, argued that cross-border trade was a critical channel for ensuring essential products reached the needy, especially at the time of the pandemic, and the TFA can play a critical role in keeping those goods moving across borders.

- The countries stressed that they were not asking for new commitments to be undertaken by WTO members but only wanted that implementation of the commitments should be accelerated, the official said.

- India informed the WTO that it was ahead of the originally scheduled dates for implementation of many of its TFA commitments and had put in place more than 73 per cent of the measures that it had promised to do. But it was not in favour of putting pressure on countries to implement their schedule of commitments.

- The TFA, concluded at the WTO’s Bali Ministerial Conference in 2013 and in force since 2017, following its ratification by two-thirds of the WTO membership, focuses on measures for expediting the movement, release and clearance of goods, including goods in transit.

- It also sets out measures for effective cooperation between customs and other appropriate authorities on trade facilitation and customs compliance issues.

- It further contains provisions for technical assistance and capacity building in this area.

- A Trade Facilitation Agreement Facility (TFAF) has been created to help ensure developing and least-developed countries obtain the assistance needed to reap the full benefits of the TFA.

- For the first time in WTO history, the requirement to implement the Agreement is directly linked to the capacity of the country to do so.

- It allowed developing and least-developed countries to group its commitments into three categories, with the first category to be implemented in the beginning and the rest following with a lag.

- Estimates show that the full implementation of the TFA could reduce trade costs by an average of 14.3% and boost global trade by up to $1 trillion per year, with the biggest gains in the poorest countries.

-

RBI to buy ₹20,000 cr. of G-Secs (TH)

- Context: The Reserve Bank of India (RBI) announced that following a review of the current liquidity and financial conditions, it had decided to purchase Government securities for an aggregate amount of ₹20,000 crore under Open Market Operations (OMO).

Analysis

Open Market Operations

- Open Market Operations are defined as purchase and sale by central bank of variety of assets such as foreign exchange, gold, Government securities or treasury bills and even company shares.

- The objective of OMO is to regulate the money supply (liquidity) in the economy.

- Liquidity has a bearing on both interest rates and inflation rates.

- When the RBI wants to increase the money supply in the economy, it purchases the government securities from the market and it sells government securities to suck out liquidity from the system.

- RBI carries out the OMO through commercial banks and does not directly deal with the public.

- OMO is one of the major monetary policy instruments that RBI uses to smoothen the liquidity conditions through the year and minimise its impact on the interest rate and inflation rate levels.

- These operations are often conducted on a day-to-day basis in a manner that balances inflation while helping banks continue to lend.

- The RBI uses OMO along with other monetary policy tools such as repo rate, cash reserve ratio and statutory liquidity ratio to adjust the quantum and price of money in the system.

- If central bank signals that it will move to a ‘neutral’ liquidity stance from a ‘deficit’ stance, it means more liquidity in the system in future. This could arm banks with more funds for lending, and lead to softer interest rates in the economy.

Government Securities Market in India

What is a Bond?

- A bond is a debt instrument in which an investor loans money to an entity (typically corporate or government) which borrows the funds for a defined period of time at a variable or fixed interest rate.

What is a Government Security (G-Sec)?

- A Government Security (G-Sec) is a tradeable instrument issued by the Central Government or the State Governments.

- It acknowledges the Government’s debt obligation.

- Such securities are short term (usually called treasury bills, with original maturities of less than one year) or long term (usually called Government bonds or dated securities with original maturity of one year or more).

- In India, the Central Government issues both, treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs).

- G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments.

- The Public Debt Office (PDO) of the Reserve Bank of India acts as the registry / depository of G-Secs and deals with the issue, interest payment and repayment of principal at maturity.

- Most of the dated securities are fixed coupon securities.

Treasury Bills (T-bills)

- Treasury bills or T-bills, which are money market instruments, are short term debt instruments issued by the Government of India and are presently issued in three tenors, namely, 91 days, 182 days and 364 days.

- Treasury bills are zero coupon securities and pay no interest.

- Instead, they are issued at a discount and redeemed at the face value at maturity.

- For example, a 91 days Treasury bill of ₹100/- (face value) may be issued at say ₹ 98.20, that is, at a discount of say, ₹1.80 and would be redeemed at the face value of ₹100/-.

Cash Management Bills (CMBs)

- Cash Management Bills (CMBs) are short-term instruments introduced to meet the temporary mismatches in the cash flow of the Government of India.

- The CMBs have the generic character of T-bills but are issued for maturities less than 91 days.

Inflation Indexed Bonds (IIBs)

- IIBs are bonds wherein both coupon flows (rate of interest) and Principal amounts are protected against inflation.

- The inflation index used in IIBs may be Whole Sale Price Index (WPI) or Consumer Price Index (CPI).

Why should one invest in G-Secs?

- Besides providing a return in the form of coupons (interest), G-Secs offer the maximum safety as they carry the Sovereign’s commitment for payment of interest and repayment of principal.

- They can be held in book entry, i.e., dematerialized/ scripless form, thus, obviating the need for safekeeping. They can also be held in physical form.

- G-Secs are available in a wide range of maturities from 91 days to as long as 40 years to suit the duration of varied liability structure of various institutions.

- G-Secs can be sold easily in the secondary market to meet cash requirements.

- G-Secs can also be used as collateral to borrow funds in the repo market.

- Securities such as State Development Loans (SDLs) and Special Securities (Oil bonds, UDAY bonds etc) provide attractive yields.

- The settlement system for trading in G-Secs, which is based on Delivery versus Payment (DvP), is a very simple, safe and efficient system of settlement.

- The DvP mechanism ensures transfer of securities by the seller of securities simultaneously with transfer of funds from the buyer of the securities, thereby mitigating the settlement risk.

- G-Sec prices are readily available due to a liquid and active secondary market and a transparent price dissemination mechanism.

- Besides banks, insurance companies and other large investors, smaller investors like Co-operative banks, Regional Rural Banks, Provident Funds are also required to statutory hold G-Secs.

- States are paying a high cost for market borrowings, while the Centre’s cost is lower at about 6%. It would have been better for the Centre to borrow from the market and transfer to the States.

Why are G-secs volatile?

- G- Sec prices fluctuate sharply in the secondary markets.

- The price is determined by demand and supply of the securities.

- The price is also influenced by the level and changes in interest rates in the economy and other macro-economic factors, such as, liquidity and inflation.

- Developments in other markets like money, foreign exchange, credit and capital markets also affect the price of the G-Secs.

- Further, developments in international bond markets, specifically the US Treasuries affect prices of G-Secs in India.

- Policy actions by RBI like change in repo rates, cash-reserve ratio and open-market operations also affect their prices.

Who are the players in the G-Secs market?

- Major players in the G-Secs market include commercial banks and primary dealers (PDs) besides institutional investors like insurance companies.

- PDs play an important role as market makers in G-Secs market.

- A market maker provides a firm two-way quotes in the market i.e. both buy and sell executable quotes for the concerned securities.

- Other participants include co-operative banks, regional rural banks, mutual funds, provident and pension funds.

- FPIs are allowed to participate in the G-Secs market within the quantitative limits prescribed from time to time.

- Corporates also buy or sell G-Secs to manage their overall portfolio.

E) Schemes/Policies/Initiatives/Social Issues

10.Regional Raw Drug Repository (RRDR) (PIB)

- Context: Inauguration of Regional Raw Drug Repository (RRDR) of National Medicinal Plants Board at All India Institute of Ayurveda, New Delhi.

Analysis

- This RRDR is the second in the series of repositories proposed by National Medicinal Plants Board (NMPB), Ministry of AYUSH and will be dedicated to the Trans-Ganga Plain Region.

- RRDR for Trans- Ganga Plain Region covers four states – Haryana, Chandigarh, Delhi and Punjab.

- Earlier, a Regional Raw Drug Repository (RRDR) for Ayurveda, Siddha and Unani medicines for the southern plateau region was set up at the National Institute of Siddha, Chennai.

- These repositories will serve as a library-cum-museum and house database of raw drugs of Ayurveda, Unani and Siddha in the southern region.

- RRDR would be involved in the collection, documentation and authentication of raw drugs gathered largely from the respective agro-climatic regions.

- The establishment of RRDRs was a component of the Union government’s National AYUSH Mission.

- The Ministry of AYUSH, through the National Medicinal Plants Board (NMPB), has initiated the establishment of the National Raw Drug Repository and Regional Raw Drug Repositories.

- Though most of the raw drugs are commonly available, there is a lack of scientific documentation that makes research on these medicines difficult.

- Easy availability of authentic scientific data of raw drugs will promote research on the medicines belonging to the AYUSH system.

- The RRDRs will not only act as a collection centre of raw drugs available and used in the respective agro-climatic region but also as an accredited reference library for authentication of raw drugs and establishment of standard protocols and keys for authentication of raw drugs used in herbal industries.

National Medicinal Plants Board

- The National Medicinal Plants Board (NMPB), established in the year 2000, is working under the Ministry of AYUSH (Ayurveda, Yoga & Naturopathy, Unani, Siddha & Homoeopathy).

- NMPB’s main objective is the overall growth (conservation, cultivation, trade and export) of medicinal plants sector both at the Central /State and International level.

- To meet increasing demand for medicinal plants NMBP focusses on in-situ & ex-situ conservation and augmenting local medicinal plants and aromatic species of medical significance.

F) Art, Culture and History

11.“Life in Miniature” project (PIB)

- Context: Union Minister of State for Culture and Tourism virtually launched “Life in Miniature” project, a collaboration between the National Museum, New Delhi, Ministry of Culture, and Google Arts & Culture.

Analysis

- Several hundred miniature paintings from the National Museum, New Delhi can be viewed online on Google Arts & Culture by people around the globe.

- The project uses technologies like machine learning, augmented reality and digitization with high-definition robotic cameras, to showcase these special works of art in a magical new way.

- On the Google Arts & Culture app, online viewers can experience the first Augmented Reality-powered art gallery designed with traditional Indian architecture, and explore a life-size virtual space where you can walk up to a selection of miniature paintings.

- The artworks showcased are presented along five universal themes of the human relationship with nature, love, celebration, faith and power.

The National Museum, New Delhi

- The National Museum, New Delhi, under the Ministry of Culture, Government of India, is the premiere cultural institution of the Nation.

- The National Museum, today, has in its possession over 2,00,000 antiquities & art objects, both of Indian and Foreign origin covering more than 5,000 years of our cultural heritage.

Google Arts & Culture

- Google Arts & Culture puts the collections of more than 2,000 museums at one’s fingertips.

- It’s an immersive way to explore art, history and the wonders of the world.