UPSC PRELIMS+MAINS

Index

- A) Schemes, Policies, Initiatives, Awards and Social Issues

- PM to Inaugurate Pravasi Bharatiya Divas Convention 2021 (PIB)

- B) Indices, Reports, Surveys, Committees and Organisations

- Bureau of Indian Standards (BIS), ISI mark and Eco Mark (PIB)

- Food and Agriculture Organization’s (FAO): World food price index (TH)

- C) Economic Developments: India and World

- India’s seventh Trade Policy Review (TPR) (PIB)

- USTR slams India’s digital tax, holds off on tariffs; ‘301’ trade probe and Equalisation Levy (TH)

- Indian Economy: Recent issues (TH, PIB)

- D) Polity, Bills, Acts and Judgments

- SC notice to Centre on plea to debar legislators (TH)

- Haryana Panchayati Raj Act provisions arbitrary (TH)

- E) Miscellaneous

- Dedicated Freight Corridor (DFC) Project (PIB)

- New Industrial Development Scheme for Jammu & Kashmir (J&K IDS, 2021) (PIB)

A) Schemes, Policies, Initiatives, Awards and Social Issues

-

PM to Inaugurate Pravasi Bharatiya Divas Convention 2021 (PIB)

- Pravasi Bharatiya Divas (PBD) Convention is the flagship event of the Ministry of External Affairs and provides an important platform to engage and connect with the overseas Indians.

- The 16th PBD Convention is being held Virtually on 9 January, 2021 in New Delhi.

- The theme of 16th PBD Convention 2021 is “Contributing to Aatmanirbhar Bharat”.

Pravasi Bharatiya Divas

- It is celebrated once in every two years to strengthen the engagement of the overseas Indian community with the Government of India.

- January 9 was chosen as the day to celebrate this occasion since it was on this day in 1915 that Mahatma Gandhi, the greatest Pravasi, returned to India from South Africa, led India’s freedom struggle and changed the lives of Indians forever.

Pravasi Bharatiya Samman Award

- The Pravasi Bharatiya Samman Award is the highest honour conferred on a Non-Resident Indian, Person of Indian Origin; or an organisation or institution established and run by Non-Resident Indians or Persons of Indian Origin, who have made significant contribution in better understanding of India abroad, support India’s causes and concerns in a tangible way, community work abroad, welfare of local Indian community, philanthropic and charitable work, etc.

Bharat Ko Janiye Quiz

- Bharat ko Janiye Quiz was launched in order to strengthen the engagement with young overseas Indians and encourage them to know more about their country of origin.

- The first edition of the online “Bharat ko Janiye” Quiz was organized for young overseas Indians and foreigners of 18-35 years of age in 2015-16.

B) Indices, Reports, Surveys, Committees and Organisations

2. Bureau of Indian Standards (BIS), ISI mark and Eco Mark (PIB)

- Context: Bureau of Indian Standards celebrated the 74th foundation day on 6th January 2021.

- The Government has recently brought “Toys” and “Helmets” under mandatory BIS certification.

Analysis

- The Bureau of Indian Standards (BIS) is the national Standards Body of India working under the aegis of Ministry of Consumer Affairs, Food & Public Distribution.

- The organisation was formerly the Indian Standards Institution (ISI) which came into being on the 06 January 1947 and in June 1947 Dr. Lal C. Verman took over as its first Director.

- In the mid-1980s, it was felt necessary to confer a statutory status to ISI’s functioning which led to the enactment of the BIS Act 1986 and the ISI was renamed as the Bureau of Indian Standards (BIS) to promote quality certification of goods, with a clearly defined statutory powers.

- The Act has now been revised as BIS Act, 2016 and establishes BIS as the National Standards Body.

- The Bureau is a Body Corporate consisting of 25 members representing both Central and State governments, Members of Parliament, industry, scientific and research institutions, consumer organizations and professional bodies; with Union Minister of Consumer Affairs, Food and Public Distribution as its President and with Minister of State for Consumer Affairs, Food and Public Distribution as its Vice-President.

- The BIS Act 2016, Rules and Regulations framed thereunder authorizes BIS to undertake conformity assessment of products, services, systems and processes.

- The Product Certification Schemes of BIS aims at providing Third Party assurance of quality, safety and reliability of products to the customer.

- BIS has been providing traceability and tangibility benefits to the national economy in a number of ways – providing safe reliable quality goods; minimizing health hazards to consumers; promoting exports and imports substitute; control over proliferation of varieties etc. through standardization, certification and testing.

- Keeping in view, the interest of consumers as well as the industry, BIS is involved in various activities as given below:

- Standards Formulation

- Product Certification Scheme

- Compulsory Registration Scheme

- Foreign Manufacturers Certification Scheme

- Hall Marking Scheme

- Laboratory Services

- Laboratory Recognition Scheme

- Sale of Indian Standards etc.

What is the ISI mark all about?

- ISI stands for the Indian Standards Institute, a body set up when India gained Independence to create standards needed for orderly commercial growth and maintaining quality in industrial production.

- By the mid-80s the country’s socio-economic climate had changed, triggering the need to set up a stronger body, the Bureau of Indian Standards (BIS), which then took over ISI.

- But the term “ISI mark” continues to be used to mean that a certain product conforms to the quality standards set up by the government.

Who can use the ISI mark?

- This certification program is basically Any manufacturer who feels confident enough that his product has the ability to meet the BIS standard can apply for product certification.

- Although, the scheme itself is voluntary in nature, the Government of India, on considerations of public health and safety, security, infrastructure requirements and mass consumption has enforced compulsory certification on various products through Orders issued from time to time under various Acts.

- In order to ensure enhanced consumer safety & compliance to statutory provisions, some products like gas cylinders, regulators and valves, BIS certification scheme requires each lot or batch to be inspected by BIS certification officers before release of the product.

Are there standards for all products?

- There are at least 16 broad categories, including textiles, packaged water, food, automobile components, plastic products and electronics, for which BIS has laid down standards.

- If anyone wants to add a new category to the current list, they can apply for it.

- For example, there is a standard for windshield wipers of four-wheelers, for the quality of silver foil used in sweets, for precast concrete slabs used in pavements and even for hooks and fasteners.

What if standards slip once the certification is obtained?

- BIS has to check conformity to the standards by regular surveillance of the licensee’s performance including surprise inspection and testing of samples, drawn both from the factory and the market.

- For launching prosecution regarding the misuse of ISI mark, testing of the sample of the product is not required.

Genuine ISI mark

- The Standard Mark for every product is unique and is notified in the Gazette of India.

Licence Number

- Licence number (a seven digit number or ten digit number or 6 digit number [for Assaying and Hallmarking Centre]), is also given along with the Standard Mark.

- This helps in identifying the unit which has manufactured the product/marked the product at a specific location.

Eco Mark Scheme

- Eco-mark is a voluntary labelling scheme for easily identifying environment-friendly products.

- The Eco-mark scheme defines as an environmentally friendly product, any product which is made, used or disposed of in a way that significantly reduces the harm it would otherwise cause the environment.

- The definition factors in all aspects of the supply chain, taking a cradle-to-grave approach, which includes raw material extraction, manufacturing and disposal.

- What sets eco-mark apart from other labels is that not only does the product have to meet strict environmental requirements, but it also has to meet strict quality requirements.

- The scheme is one of India’s earliest efforts in environmental standards, launched in 1991, even before the 1992 Rio Summit in which India participated.

- The scheme was launched by the Ministry of Environment and Forests, and is administered by the Bureau of Indian Standards (BIS), which also administers the Indian Standards Institute (ISI) mark quality label, a requirement for any product to gain the Eco-mark label.

- The Eco-mark Scheme covers various product categories like Soaps and Detergents, Paints, Food Items, lubricating oils, Packaging materials/Package, Architectural Paints and Powder Coatings, Batteries, Electrical and electronic goods, Food Additives, Wood Substitutes, Cosmetics, Aerosols and Propellants, Plastic Products, Textiles, Fire-extinguisher, Leather and Coir & Coir Products.

- Products certified as eligible for the Eco Mark shall also carry the ISI Mark (except for leather) for quality, safety and performance of the product and shall be licensed to carry the ECO Mark for a prescribed time period after which it shall be reassessed.

- For this purpose the Standard Mark of Bureau would be a single mark having a combination of the ISI Mark and the ECO Logo which is illustrated below:

-

Food and Agriculture Organization’s (FAO): World food price index (TH)

- Context: Food and Agriculture Organization’s (FAO) food price index, which measures monthly changes for a basket of cereals, oilseeds, dairy products, meat and sugar, averaged 107.5 points last month versus 105.2 in November.

- FAO Food Price Index has hit a three-year high in 2020, following additional gains in December.

- The FAO Food Price Index (FFPI) is a measure of the monthly change in international prices of a basket of food commodities. It consists of the average of five commodity group price indices weighted by the average export shares of each of the groups over 2014-2016.

Analysis

- The Food and Agriculture Organization (FAO) is a specialized agency of the United Nations that leads international efforts to defeat hunger.

- Its goal is to achieve food security for all and make sure that people have regular access to enough high-quality food to lead active, healthy lives. With over 194 member states, FAO works in over 130 countries worldwide.

- Established in 1945, the Food and Agriculture Organisation (FAO) has its headquarters in Rome, Italy.

B) Economic Developments: India and World

4.India’s seventh Trade Policy Review (TPR) (PIB)

- Context: India’s seventh Trade Policy Review (TPR) began 6th January 2021 at the World Trade Organization in Geneva.

Analysis

- The TPR is an important mechanism under the WTO’s monitoring function, and involves a comprehensive peer-review of the Member’s national trade policies. India’s last TPR took place in 2015.

- India has advocated a short-term package of effective measures at the WTO that includes:

- a temporary waiver of certain TRIPS provisions to increase manufacturing capacity and ensure timely and affordable availability of new diagnostics, therapeutics and vaccines for COVID-19;

- a permanent solution for Public Stockholding (PSH) for food security purposes to address food security concern; and

- a multilateral initiative that provides for easier access to medical services under mode-4 to facilitate easier cross-border movement of health care professionals.

Analysis

- These reviews are part of the Uruguay Round agreement, but they began several years before the round ended.

- Annex 3 to the Marrakesh Agreement, agreed by Members in April 1994, placed the Trade Policy Review Mechanism (TPRM) on a permanent footing as one of the WTO’s basic functions.

- Initially they operated under General Agreement on Tariffs and Trade (GATT) and, like GATT, they focused on goods trade.

- With the creation of the WTO in 1995, their scope was extended, like the WTO, to include services and intellectual property.

- The objectives of the TPRM, as expressed in Annex 3 of the Marrakesh Agreement, include:

- to increase the transparency and understanding of countries’ trade policies and practices, through regular monitoring

- to improve the quality of public and intergovernmental debate on the issues

- to enable a multilateral assessment of the effects of policies on the world trading system.

- All WTO members are reviewed, the frequency of each country’s review varying according to its share of world trade.

- The Annex mandates that the four Members with the largest shares of world trade (currently the European Union, the United States, Japan and China) be reviewed each three years, the next 16 be reviewed each five years, and others be reviewed each seven years.

- A longer period may be fixed for least-developed country Members.

How the reviews are organized

- The reviews take place in the Trade Policy Review Body which is actually the WTO General Council — comprising the WTO’s full membership — operating under special rules and procedures.

- The reviews are therefore essentially peer-group assessments, although much of the factual leg-work is done by the WTO Secretariat.

- Reviews are conducted by the Trade Policy Review Body (TPRB) on the basis of a policy statement by the Member under review and a report prepared by economists in the Secretariat’s Trade Policy Review Division.

-

USTR slams India’s digital tax, holds off on tariffs; ‘301’ trade probe and Equalisation Levy (TH)

- Context: Digital services taxes imposed by France, India, Italy and Turkey discriminate against big U.S. tech firms, such as Google, Facebook, Apple and Amazon.com and are inconsistent with international tax principles, the U.S. Trade Representative (USTR)’s office said on Wednesday (7 Dec 2021), paving the way for potential retaliatory tariffs.

Analysis

- USTR, releasing the findings of its “Section 301” investigations into the digital taxes, said it was not taking specific actions at this time, but “will continue to evaluate all available options.”

- India on Thursday said the 2% equalization levy does not discriminate against U.S. companies as it applies equally to all non-resident e-commerce operators irrespective of their country of residence, Press Trust of India reported.

- In a statement, the Commerce and Industry Ministry said the purpose of the levy is to ensure fair competition, reasonableness and exercise the ability of governments to tax businesses that have a close nexus with the Indian market through their digital operations.

- It also does not have extraterritorial application as it applies only on the revenue generated from India, the ministry said.

‘301’ trade probe

- The ‘301’ probe is a trade tool authorized by Section 301 of the U.S. Trade Act of 1974 which the U.S. uses to assert its rights under trade agreements if it decides American industries are facing “unfair” foreign trade practices.

- Having used the World Trade Organization’s (WTO) dispute settlement mechanism alone in recent times, the U.S., under the Trump administration, has brought the 301 back into use, launching a 2017 probe against China.

Equalisation Levy in News: 8th July 2020

- The government is exploring changes to the equalisation levy, and may stop charging the tax on digital transactions either partially or in its entirety for a year, people with direct knowledge of the matter said.

- The government is doing a cost-benefit analysis and has reached out to stakeholders to figure out if it needs to suspend or shelve the 2% equalisation levy imposed this fiscal year on any purchase by an Indian or India-based entity through an overseas ecommerce platform.

- The 2% equalisation levy in its current form is too widely worded, needs clarity and could be challenged as lacking constitutional validity as it brings thousands of transactions made online under its scope.

- The 2% equalisation levy was introduced in the 2020-21 Budget and came into effect from April 1.

- Many Indian startups and stakeholders are also pushing to shelve or reduce the 6% equalisation levy, the so-called Google tax, charged on the advertising revenue that overseas companies such as Google, Facebook and Netflix generate from India.

- The burden of this tax eventually falls on the local startups and others who advertise on these platforms, as most digital majors pass on it to them.

- The equalisation levy, introduced in 2016 Union Budget, is a direct tax on payments made by residents to non-resident companies for online advertisement, provision of digital and advertising space or any other facility or service for online advertisement.

- India is the first country to impose such a levy, post the Organization for Economic Cooperation and Development (OECD) action plan.

- A tax panel has recommended expanding the ambit of this levy to cover a wide gamut of transactions including online marketing, cloud computing, website designing, hosting and maintenance, platforms for sale of goods and services, and online use of or download of software and applications.

- At a time when all of these players are expanding their presence in India, it only makes sense to shelve the 6% equalisation levy, and instead make regulations to make sure global digital companies have Indian legal entities, invoice from here and pay GST and other taxes just like Indian companies.

- The government is also looking to introduce personal data protection Bill that would require these players to have their servers and data in India. If these companies have an India presence, they could face both direct taxes like income tax and indirect taxes such as GST, and also on a much larger portion of their revenue.

-

Indian Economy: Recent issues (TH, PIB)

- Context: India’s fiscal deficit for the year ending in March is likely to exceed 7% of gross domestic product, as revenue collections suffered from a lockdown and restrictions to rein in the spread of COVID-19.

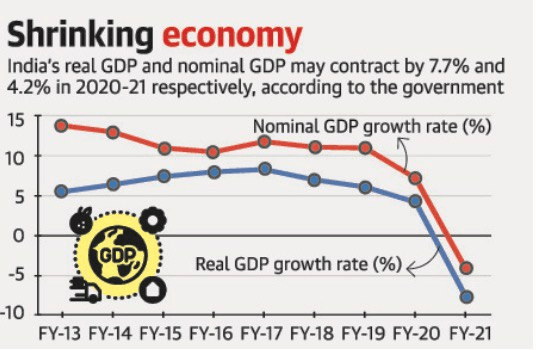

- India’s real GDP (Gross Domestic Product) is estimated to contract by 7.7% in 2020-21, with GVA (Gross Valued added) shrinking by 7.2%, advance estimates released by the National Statistical Office on Thursday show.

- India’s economy had expanded 4.2% in 2019-20, but entered a recessionary phase with two successive quarters of sharp contraction triggered by the COVID-19 lockdowns.

- The National Statistical Office (NSO), Ministry of Statistics and Programme Implementation has also released the First Advance Estimates of National Income at both Constant (2011-12) and Current Prices, for the financial year 2020-21 along with the corresponding estimates of expenditure components of the Gross Domestic Product (GDP).

How to read GDP data – GVA vs GDP

- There are two main ways in which the Central Statistics Office (CSO) estimates economic growth: Gross Value Added (GVA) and Gross Domestic Product (GDP).

- GVA is from the supply side — that is, by mapping the value-added (in rupee terms) by the various sectors in the economy.

- GVA tracks the income generated for all the workers in the economy.

- The GDP is arrived at from the demand side.

- It is calculated by mapping the expenditure made by different categories of spenders.

- Broadly speaking, there are four sources of expenditure in an economy — namely, private consumption, government consumption, business investments, and net exports (exports minus imports).

- Because the GDP maps final expenditure, it includes both taxes and subsidies that the government receives and gives.

- This component, net taxes, is the difference between GVA and GDP.

- Typically, GDP is a good measure when you want to compare India with another economy, while GVA is better to compare different sectors within the economy.

- GVA is more important when looking at quarterly growth data, because quarterly GDP is arrived at by apportioning the observed GVA data into different spender categories.

Fiscal deficit and other economy-related terms

- Gross Fiscal Deficits defined as the excess of total expenditure of the government over the total non-debt creating receipts.

- Net fiscal deficit can be arrived at by deducting net domestic lending from gross fiscal deficit.

- Revenue deficit arises when the government’s actual net receipts is lower than the projected receipts.

- Revenue deficit signifies that government’s own earning is insufficient to meet normal functioning of government departments and provision of services.

- An increase in the ratio of revenue deficit to gross fiscal deficit indicates an increase in the utilization of borrowed funds for revenue purposes.

- It indicates increase in liabilities of the Central Government without increase in the assets of that Government.

- The difference between fiscal deficit and revenue deficit is the government’s capital expenditure.

- Effective Revenue Deficit

- In the 2012-13 budget, the concept of effective revenue deficit was introduced that excluded grants for the creation of capital assets from conventional revenue deficit.

- Effective Revenue Deficit is the difference between revenue deficit and grants for creation of capital assets.

- Grants for creation of capital assets are defined as “the grants-in-aid given by the Central Government to the State Governments, constitutional authorities or bodies, autonomous bodies and other scheme implementing agencies for creation of capital assets which are owned by the said entities”.

- The concept of effective revenue deficit has been suggested by the Rangarajan Committee on Public Expenditure.

- It is aimed to deduct the money used out of borrowing to finance capital expenditure.

- The concept has been introduced to ascertain the actual deficit in the revenue account after adjusting for expenditure of capital nature.

- Focusing on this will help in reducing the consumptive component of revenue deficit and create space for increased capital spending.

- Trade deficit: A nation has a trade deficit if the total value of goods and services it imports is greater than the total value of those it exports.

- Primary Deficit: It is the difference between the current year’s fiscal deficit (total income – total expenditure of the government) and the interest paid on the borrowings of the previous year.

- Primary Deficit = Fiscal Deficit (Total expenditure – Total income of the government) – Interest payments (of previous borrowings).

- Fiscal deficit is also defined as the difference between the total expenditure of the government and its total income.

- What does Primary Deficit indicate? Primary deficit is measured to know the amount of borrowing that the government can utilize, excluding the interest payments.

- A decrease in primary deficit shows progress towards fiscal health.

- Note that the difference between the primary deficit and fiscal deficit reflects the amount of interest payment on public debt generated in the past.

- Hence, when the primary deficit is zero, the fiscal deficit becomes equal to the interest payment. This means that the government has resorted to borrowings just to pay off the interest payments. Further, nothing is added to the existing loan.

- Budget Deficit and Monetized Deficit are the deficits on the basis of financing.

- Fiscal Deficit, Primary Deficit, Revenue Deficit and Effective Revenue Deficit are the deficits on the basis of type of transactions.

- Factor income: It is determined by subtracting income made by citizens of a country on their foreign investments from income earned by foreigners on their investments within the country.

- Current/Financial transfers: They include interest earnings, foreign remittances, donations, aids and grants, official assistance, pensions etc.

- Current account deficit/balance: trade deficit + factor income + financial transfers OR

- CAD/CAB = (X−M) + (NY+NCT) where:

- X = Exports of goods and services

- M=Imports of goods and services

- NY=Net income abroad

- NCT=Net current transfers

- Balance of payments: The balance of payments is the sum of all transactions between a nation and all of its international trading partners.

Fiscal expansion

- Fiscal expansion is generally defined as an increase in economic spending owing to actions taken by the government.

- Expansionary fiscal policy can also lead to inflation because of the higher demand in the economy.

- A general increase in overall spending can cause the cash flow leaving the country to increase as consumers and the government both purchase more. This increases the debit side of the balance of payments.

- Fiscal expansion generally worsens the Inflation and Balance of payments.

C) Polity, Bills, Acts and Judgments

7.SC notice to Centre on plea to debar legislators (TH)

- Context: The Supreme Court asked the Centre and the Election Commission of India (EC) to respond to a plea to debar legislators, disqualified under the Tenth Schedule, from contesting byelections during the rest of the tenure of the House.

- The petitioner referred to recent events in Karnataka and Madhya Pradesh.

Analysis

- Article 164 (1) (b): A member of the Legislative Assembly of a State or either House of the Legislature of a State having Legislative Council belonging to any political party who is disqualified for being a member of that House under the Tenth Schedule shall also be disqualified to be appointed as a Minister for duration of the period commencing from the date of his disqualification till the date on which the term of his office as such member would expire or where he contests any election to the Legislative Assembly of a State or either House of the Legislature of a State having Legislative Council, as the case may be, before the expiry of such period, till the date on which he is declared elected, whichever is earlier.

- Article 361 (B): A member of a House belonging to any political party who is disqualified for being a member of the House under the Tenth Schedule shall also be disqualified to hold any remunerative political post for duration of the period commencing from the date of his disqualification till the date on which the term of his office as such member would expire or till the date on which he contests an election to a House and is declared elected, whichever is earlier.

- Note: Tenth Schedule of the Constitution for Defection and Disqualifications for membership was covered comprehensively in 28th Nov file.

-

Haryana Panchayati Raj Act provisions arbitrary (TH)

- Context: Terming the provisions in the Haryana Panchayati Raj (Second Amendment) Act, 2020 as arbitrary and unconstitutional, senior Congress leader Karan Singh Dalal has asked Governor Satyadev Narayan Arya to get the Act annulled.

- Dalal has pointed out that sub-Section 3 of Section 9 of the Act caps the participation of women in local bodies at 50%.

- For details, refer to 8th Nov file.

D) Miscellaneous

9.Dedicated Freight Corridor (DFC) Project (PIB)

- Prime Minister Shri Narendra Modi dedicated to the nation the 306 km long Rewari – Madar section of the Western Dedicated Freight Corridor (WDFC) today through video conference.

- Refer in details, 28th Dec file.

-

New Industrial Development Scheme for Jammu & Kashmir (J&K IDS, 2021) (PIB)

- Ministry of Commerce & Industry has formulated New Industrial Development Scheme for Jammu & Kashmir (J&K IDS, 2021) as Central Sector Scheme for the development of Industries in the UT of Jammu & Kashmir.

- The main purpose of the scheme is to generate employment which directly leads to the socio-economic development of the area.

- For the first time, any industrial incentive scheme is taking industrial development to the block level.

- Scheme while encouraging new investment, also nurtures the existing industries in J&K by providing them working capital support at the rate of 5% for 5 years.